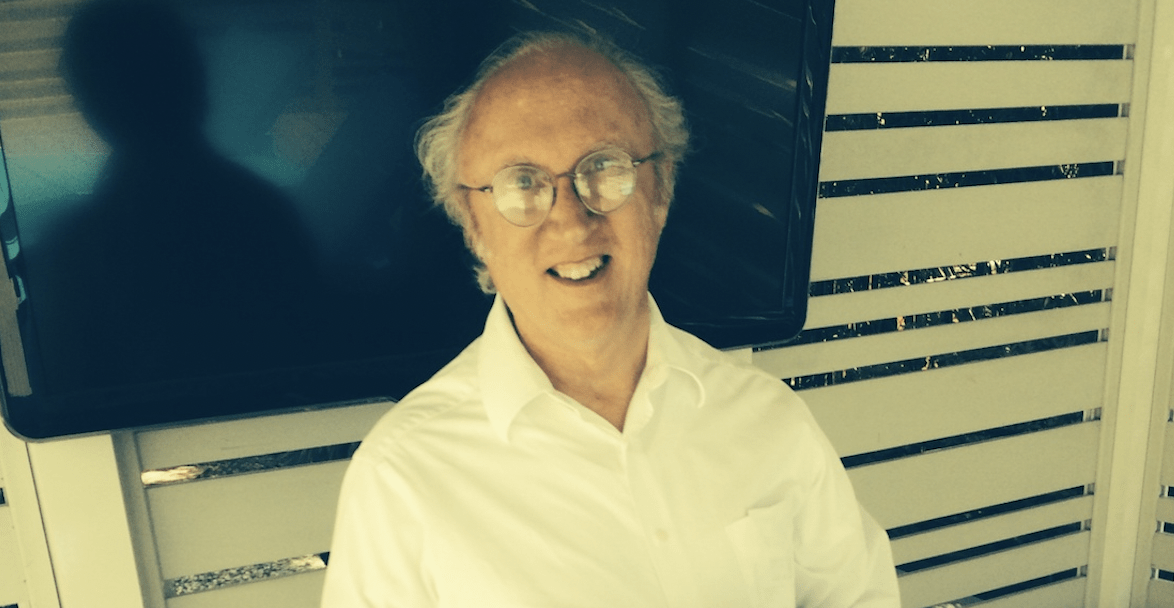

Christopher R. Esposito Charged with Securities Fraud

On January 7, 2022, Christopher R. Esposito, 55, of Everett, was charged and has agreed to plead guilty to one count of securities fraud.

Esposito, the sole officer and director of Massachusetts marketing firm Code2Action Inc, was charged in connection with misappropriating tens of thousands of dollars of investor funds to pay his personal expenses.

According to court filings, between August 2019 and February 2020, Esposito allegedly sold Code2Action shares to existing shareholders at sub-penny prices based on material misstatements and omissions and then misappropriated much of the proceeds. Specifically, it is alleged that Esposito deliberately misled prospective investors about, among other things, Code2Action’s plan and ability to complete a reverse merger, which Esposito touted would enable the investors to sell their shares at a profit.

It is further alleged that Esposito misappropriated over $57,000 to pay his personal expenses and failed to disclose to prospective investors, among other things, that the U.S. Securities and Exchange Commission had previously obtained a final judgment against him for committing securities fraud and barred him from certain securities-related activities.

SEC Commissioners Differ on Key Policies

Just before the end of 2021, Elad L. Roisman, one of the SEC’s five Commissioners, announced his resignation, effective at the end of January 2022. In a statement posted on the agency’s website, he said:

Serving the American people as a Commissioner and an Acting Chairman of this agency has been the greatest privilege of my professional life. It has been the utmost honor to work alongside my extraordinary SEC colleagues, who care deeply about investors and our markets. Over the next several weeks, I remain committed to working with my fellow Commissioners and the SEC’s incredible staff to further our mission of protecting investors, maintaining fair, orderly, and efficient markets, and facilitating capital formation.

Chairman Gary Gensler replied publicly, saying:

Today, my colleague and fellow Commissioner Elad Roisman announced his intentions to step away from the agency in January. I’d like to thank Commissioner Roisman for his dedicated service to the Commission and to the American public, both as a Commissioner and as Acting Chairman. While we didn’t always agree on policy matters, I’ve come to rely on his judgment and expertise, and I have enjoyed a positive working relationship with him.

The polite exchange glossed over conflicts that had been on the increase since Gensler’s appointment. The new chair arrived full of plans of his own, plans that didn’t necessarily fit with projects undertaken by the Commission months or even years earlier. He created an agenda that changed priorities already decided on by his colleagues and revived old issues, some of them quite recently decided, for reconsideration. He was the boss, and that was his right to do, but it ruffled the feathers of two of his fellow Commissioners, Roisman and Hester Pierce.

Five Russians Charged in Hacking and Illegal Trading Scheme

On December 20, 2021, the Securities and Exchange Commission announced fraud charges against five Russian nationals for engaging in a multi-year scheme to profit from stolen corporate earnings announcements obtained by hacking into the systems of two U.S.-based filing agent companies before the announcements were made public.

The SEC’s complaint, filed in federal district court in Massachusetts, alleges that defendant Ivan Yermakov, also known as Ivan Ermakov, used deceptive hacking techniques to access the filing agents’ systems and directly or indirectly provided not-yet-public corporate earnings announcements stolen from those systems to his co-defendants Vladislav Kliushin, Nikolai Rumiantcev, Mikhail Irzak, and Igor Sladkov.

According to the complaint, from 2018 through 2020, the traders used 20 different brokerage accounts located in Denmark, the United Kingdom, Cyprus and Portugal to generate profits of at least $82 million using the stolen information to make trades before over 500 corporate earnings announcements. The defendants allegedly shared a portion of their enormous profits by funneling them through, M-13, a Russian information technology company founded by Kliushin and for which Yermakov and Rumiantcev serve as directors.

More Individuals Charged in Billion Dollar Penny Stock Pump and Dump/Money Laundering Operation

On Thursday, December 9th, three more Canadian citizens were charged by the Securities and Exchange Commission as part of what has been described as a long-running global pump and dump scheme that collectively generated over a billion dollars from unlawful stock sales.

According to the SEC’s complaint, between at least 2011 and 2016, Jay Scott Kirk Lee, Geoffrey Allen Wall, and Benjamin Thompson Kirk allegedly were able to utilize a network of offshore front companies to conceal their control of shares in penny stocks, unload those shares on unsuspecting retail investors, and disburse the proceeds of their fraud to various bank accounts throughout the world.

The SEC’s complaint further alleges that Canadian resident Frederick L. Sharp masterminded a complex scheme from 2011 to 2019 in which he and his associates – Canadian residents Zhiying Yvonne Gasarch and Courtney Kelln – enabled control persons of microcap companies whose stock was publicly traded in the U.S. securities markets to conceal their control and ownership of huge amounts of penny stocks. They then surreptitiously dumped the stock into the U.S. markets in violation of federal securities laws.

The services Sharp and his associates allegedly provided included furnishing networks of offshore shell companies to conceal stock ownership, arranging stock transfers and money transmittals, and providing encrypted accounting and communications systems. According to the complaint, Sharp and his associates facilitated over a billion dollars in gross sales in hundreds of penny stock companies.

SEC Charges Robert Gandy and Others in 3(a)(10) Penny Stock Scheme

On November 9, 2021, the Securities and Exchange Commission charged four individuals and their companies, including a securities fraud recidivist, with scheming to issue free-trading shares of two penny stock companies through the use of bogus documents in 3(a)(10) court proceedings and backdated promissory notes. The SEC’s complaint named New York-based CF3 Enterprises, LLC and its owner Clarence Fitchett, Texas-based Silverback Promotions, LLC and its manager Robert Gandy, Kathy Givens-Gandy, and Billy Chang as defendants.

The SEC alleges that, between 2017 and 2018, Fitchett and Robert Gandy abused the judicial system to obtain unrestricted or “free-trading” securities of two microcap issuers, Quantum Medical Transport, Inc. (“DRWN”) and Macau Capital Investment, Inc. (“MCIM”), pursuant to Section 3(a)(10) of the Securities Act of 1933. This provision provides an exemption from registration when a company issues securities in exchange for one or more bona fide debts when a court approves the terms and conditions of the transaction.

Amended Rule 15c2-11 is Bad News for Shell Vendors

Though nearly two months have passed since compliance with the Securities and Exchange Commission’s amended Rule 15c2-11 became mandatory on September 28, 2021, the OTC marketplace is still reeling from the effects of its implementation. The new rule requires all OTC issuers to make “current information” available to investors and the general public. For most, that means qualifying for OTC Markets’ Pink Current Info tier, or, at a minimum, its Limited Information tier.

Results have been dramatic. Thousands of penny stocks have been sent to OTC Markets’ “Expert” tier, where they have no published quotations. U.S. broker-dealers are not allowing their customers to purchase them, though liquidating trades are permitted. While this serves to protect genuine investors, as the rule intended, it’s a serious obstacle for those penny players interested in the kind of speculation that can result in large gains (or losses).

Not so long ago, much of that speculation was fueled by “reverse merger plays,” in which specialist shell vendors would seek custodianship of public shell companies that had been abandoned by management in their states of incorporation. Once a petition for custodianship had been granted by a local court, control of the shell would pass to the shell vendor. He would then reinstate the company’s corporate charter—or, if it had been abandoned many years earlier, “revive” it—and pay delinquent fees to the Secretary of State. He could then present himself to the shell’s transfer agent. His ultimate goal would be to find a buyer for the shell. The buyer would be the owner of a private company who wished to take his business public through a reverse merger transaction.

The amended Rule 15c2-11 has made all that far more difficult to accomplish. One of the objects of the new rule was to reduce the number of shell companies in the OTC market. The SEC has long realized that dormant shells are often purchased by individuals who intend to use them in pump and dump operations or other kinds of manipulative schemes. In the hope of putting a stop to that, the new rule specifies that a shell company can only continue to trade for 18 months following its initial quotation by a market maker. If it is still a shell after that time, it will no longer qualify for public quotation. In other words, OTC shells would be subject to some of the limitations imposed on special purpose acquisition companies (SPACs).

That was very bad news for the shell vendors. Some seem to have digested it and found new ways to make money; others have not. One of the latter is Benjamin Berry, who runs a company called Synergy Management Group. Synergy is, according to its website, located in Chicago and Minneapolis. Berry says of his company: “We are specialists that strive to create value for shareholders of distressed public companies.”

Unregistered Dealer Activity Not Just For the SEC Anymore

Over the past few years, we’ve written frequently about so-called “toxic lenders” engaged in unregistered dealer activity and the toll their loans take on struggling over-the-counter companies. Nearly all of these companies need financing for operations, research and development, expansion and more, and are rarely able to obtain it from banks or other traditional lenders. They turn instead to the toxic funders, who charge high interest and, in the end, almost always convert their notes into enormous amounts of unrestricted stock. That causes runaway dilution, which damages the companies and their investors, and can result in reverse splits and even bankruptcy.

Since 2017, the Securities and Exchange Commission (“SEC”) has been trying to deal with the problem by suing the lenders for acting as unregistered dealers. Though they’ve won one important victory—against Ibrahim Almagarby and his company Microcap Equity Group LLC—and others are waiting in the wings, preparing and prosecuting individual lawsuits is time-consuming and expensive. The SEC has another remedy in mind, which entails changing the way note conversions work under Rule 144, but the rule change has yet to become effective. In the meanwhile, issuers victimized by toxic lenders try to fight back as best they can.

One such company, GeneSYS ID, Inc., won a significant victory when the New York State Court of Appeals held that GeneSYS ID’s lender, Adar Bays, had committed criminal usury and that the contract between lender and borrower was void ab initio.

Steven Gallagher Arrested And Charged With Securities Fraud For Using His Twitter Account To Operate A Pump-And-Dump Scheme

On Tuesday, October 26th, Steven Gallagher 50, of Maumee, Ohio, was arrested and charged with securities fraud, wire fraud, and market manipulation.

According to the Complaint filed in Manhattan federal court, Gallagher created a stock promotion account on Twitter using the alias “Alex DeLarge,” in September 2019 based on a character from the Anthony Burgess novel A Clockwork Orange and the Stanley Kubrick film of the same name @AlexDelarge6553.

The account was used to make thousands of tweets touting certain over-the-counter penny stocks and to disseminate false and misleading information about Gallagher’s trading in those stocks in order to induce his followers to purchase those stocks and drive up their prices. As alleged, Gallagher would then sell those stocks at the inflated prices without disclosing his sales.

As of October 19, 2021, the DeLarge Twitter Account had over 70,000 followers.

Will Small Cap Investors Embrace Donald Trump’s DWAC? The latest Reddit Meme Stock

Since the fall of 2019, we’ve written a number of times about the Securities and Exchange Commission’s amendments to Rule 15c2-11, which, most importantly, require over-the-counter stocks to provide “current information” to the public. Since the end of September of this year, compliance has been required, bringing dramatic changes to the penny stock market. So where will retail players in search of potentially dramatic gains turn? Many have moved to lower-tier NASDAQ or struggling NYSE issuers, with surprising results.

The SEC requirements forbid broker-dealers to publish quotations for any OTC issuer that fails to meet its new requirements; the regulator’s intention was that the stocks in question would be moved to the Grey Market and left there to wither away. OTC Markets had hoped to soften the blow by instead placing them on its “Expert Market,” where it further hoped public quotations could at least be offered to brokers, institutions, and accredited investors. The SEC declined to consider that proposal at this time. The “no info” stocks have indeed been moved to the Expert Market, and nearly all of them are billed as quoted on an unsolicited basis, which ought to mean quotes would be available to all comers. But U.S. broker-dealers, who are regulated by both the SEC and the Financial Industry Regulatory Authority, aren’t taking chances: those stocks cannot be purchased by their customers; only liquidating transactions are permitted. (Most Canadian brokerages do allow buys, but that is not generating much volume.)

On October 15, OTC Markets reported that “2,247 former Pink No Information securities shifted to the Expert Market tier, where securities may only be quoted on an Unsolicited (customer order) basis.” Three days later, TDAmeritrade published its own list of securities clients cannot purchase. It contains 5,870 items, though not all of them are equities.

Despite OTC Markets’ brave words about an increase in foreign issuers making use of its services, the penny market is in the doldrums from our perspective. There’s less interest, with lower trading volumes. But retail players haven’t just given up; they’ve gone elsewhere.

They haven’t found just one refuge. Some have migrated to the so-called “meme stocks”; others have been buying stock and warrants in special purpose acquisition companies, known as “SPACs.”

Federal Jury Convicts Defendants In NuTech Energy Resources Securities Fraud

On Wednesday, October 13, 2021, a federal jury in Cheyenne returned guilty verdicts against a Pennsylvania man and two Florida men related to a stock fraud involving NuTech Energy Resources Inc., a company that claimed to operate coalbed-methane wells in Wyoming.

Justin Herman, 50, of Canonsburg, Pennsylvania, and Charles “Chuck” Winters Jr., 61, of Bradenton, Florida, were convicted of fraud and identity theft crimes.

Attorney Ian Horn, 67, of Brandon, Florida, was acquitted of the charged fraud crimes but convicted of making a false statement to the grand jury.

According to court documents and evidence presented at trial, Herman and Winters conspired with Robert “Bob” Mitchell, who pleaded guilty earlier this year, to pump and dump NuTech stock.

In this case, the conspirators bought control of a publicly-traded shell company called EcoEmissions Solutions Inc. and changed the company’s name to NuTech Energy Resources, whose stock was sold under the ticker symbol NERG. The conspirators released information online to create a false image for NuTech as a company located in Gillette operating gas wells in Wyoming using patented technology. In reality, NuTech had no business, no revenue, and no paid employees in Wyoming or elsewhere.

SEC Charges Webcast Host Mark Melnick for His Role in Market Manipulation Scheme

On September 30, 2021, the Securities and Exchange Commission (the “SEC”) announced charges against Mark Melnick, a day trader and T3 Live Senior Trading Strategist for spreading more than 100 false rumors about public companies in order to generate illicit profits.

Melnick is the second individual charged in the scheme. The SEC previously charged Barton Ross for his role in this scheme.

According to the complaint, filed in the United States District Court for the Northern District of Georgia, between January 2018 and January 2020, Melnick, Ross, and other individuals conspired to execute a scheme in which they traded securities—primarily short-term call options—in large, publicly traded companies (often Fortune 500 companies) based on materially false rumors about those companies that they generated and disseminated. These materially false rumors were intended to drive up the price of the securities (both the underlying stock and options).

SEC Obtains Emergency Relief Against Richard Xia Charged with EB-5 Securities Fraud

On September 28, 2021, the Securities and Exchange Commission (the “SEC”) announced that it filed an emergency action and obtained an asset freeze, among other relief, against Richard Xia (aka Yi Xia) and his company, Fleet New York Metropolitan Regional Center LLC (formerly known as Federal New York Metropolitan Regional Center LLC), for committing securities fraud in connection with two real estate projects in Queens, New York.

The SEC’s complaint alleges that from 2010 through late 2017, Xia fraudulently raised more than $229 million through five EB-5 offerings from more than 450 investors through Fleet.

The funds were allegedly raised for Xia’s two real estate development projects – the Eastern Mirage project and the Eastern Emerald project.

According to the complaint, the offering materials made material misrepresentations regarding the sources of financing for the projects, the experience of the projects’ development and construction team, the scope of the Eastern Emerald project, and the existence of lease agreements among several entities that Xia owns and controls.

SEC Sues Carebourn Capital, L.P. and Its Managing Partner Chip Rice for Acting as an Unregistered Securities Dealer

On September 24, 2021, the Securities and Exchange Commission (“SEC”) charged Carebourn Capital, L.P. and its managing partner Chip Rice of Maple Grove, Minnesota, with acting as unregistered securities dealers in connection with their buying and selling of billions of newly-issued shares of microcap securities, or “penny stocks,” which generated millions of dollars for Carebourn Capital and Rice. Also named as a relief defendant is another Rice-controlled entity, Carebourn Partners, LLC.

The SEC’s complaint alleges that Rice and Carebourn Capital’s business model was to buy convertible promissory notes – a type of security – from penny stock issuers, convert the notes into newly issued shares of stock, and quickly sell those shares into the public market at a profit. The SEC further alleges that, since January 2017, Rice and Carebourn Capital purchased more than 100 such notes from approximately 40 different penny stock issuers. According to the SEC complaint, Rice and Carebourn Capital negotiated and received highly favorable terms for these notes, including terms that gave them deep discounts from the prevailing market price for the shares of counterparty penny stock issuers.

Section 12(j) – SEC Termination of Registration, Revocation and Trading Suspensions

Proceedings under Section 12(j) of the Securities Exchange Act of 1934, (the “Exchange Act”) are frequently initiated when an SEC reporting company has failed to comply with its SEC reporting requirements. Section 12(j) authorizes the SEC to revoke an issuer’s Exchange Act registration for failure to comply with any provision of the Exchange Act or any of the regulations promulgated thereunder. Section 12(j) also prohibits broker-dealers from effecting transactions in the securities of any issuer whose registration has been so revoked. The entry of a Section 12(j) order is, therefore, effectively stops the public trading of an issuer’s securities.

Section 13(a) of the Exchange Act and the rules promulgated thereunder require companies with a class of securities registered pursuant to Exchange Act Section 12 to file current and accurate information in periodic reports, even if the registration is voluntary under Section 12(g). Rule 13a-1 requires issuers to file annual reports, and Rule 13a-13 requires domestic issuers to file quarterly reports. Reporting companies that do not to comply with their SEC reporting requirements face that risk that their securities will be suspended for up to twelve months, or their Exchange Act registration will be revoked. Read More

SEC Charges Two Individuals for Wash Trading Scheme Involving Options of “Meme Stocks”

Today, the Securities and Exchange Commission charged a Florida resident and his friend for engaging in a fraudulent scheme designed to collect liquidity rebates from exchanges by wash trading put options of certain “meme stocks” in early 2021.

According to the SEC’s complaint, filed in the United States District Court for the District of New Jersey, starting in late February 2021, Suyun Gu became aware of the increased market volume and volatility driven by so-called “meme stocks” – stocks that were being actively promoted on social media platforms. Gu allegedly then devised a scheme to take advantage of the “maker-taker” program offered by exchanges by trading options of these stocks with himself.

Forms 211: OTC Markets’ New Role – Quotation, Trading Suspensions and Listing

We’ve written several times about the Securities and Exchange Commission’s (“SEC”) amendments to Rule 15c2-11, first proposed in September 2019 and adopted in September 2020. The amended rule will finally become effective on September 28, 2021. That is important because no stock that trades over-the-counter can trade at all unless it’s compliant with the relevant provisions of the rule.

The Financial Industry Regulatory Authority (“FINRA”) has always played a significant role in the practical application of Rule 15c2-11. It once administered and operated the OTC Bulletin Board (“OTCBB”) and dealt with the issuers that traded on it. Just before the turn of the new century, the SEC decided that all OTCBB companies had to register stock with the Commission or be dumped to the lowly Pink Sheets. The Pinks had recently been purchased by a group of investors who believed they could make a go of them, and they went on to do just that, eventually changing the name to OTC Markets Group. The OTCBB died a slow death, largely due to FINRA’s lack of interest and failure to innovate; on September 17, FINRA announced it would “retire” the OTC Bulletin Board entirely at a date not yet fixed, but probably in the fourth quarter of this year. (That announcement has been made several times in the past five years; the OTCBB seems always to be on its way out but not quite gone.)

FINRA continues to process corporate action requests by OTC issuers and to process Forms 211. When an issuer wants to initiate or resume quotation until now, it’s needed to find a sponsoring market maker willing to file a Form 211. In order to do so, he needed to obtain information from the company, including financial statements that needed to be accurate but not audited, and send the completed form to FINRA. If anything in the documentation is incorrect, the sponsoring market maker could be found liable. He was not permitted to charge for preparing and submitting a Form 211.

Amended Rule 15c-211 Is Only a Week Away – Going Public, Form S-1, Form 211

We last wrote about the Securities and Exchange Commission’s new Rule 15c2-11 in early August. The amended rule was proposed in September 2019; the final rule appeared in September 2020. Now the compliance deadline, September 28, 2021, is only a week away. Penny players holding “no information” stocks hope against hope management will show up and make just enough disclosure to OTC Markets Group to qualify for the bare minimum required by the SEC. That means a single annual report dated within the past 16 months, enough to send the stock in question to OTC Markets’ Pink Limited Information tier.

No one was expecting new developments so late in the day, when Brian Chappatta, a Bloomberg opinion columnist and bond expert, found a joint letter sent to the SEC on August 6 by the Securities Industry and Financial Markets Association (“SIFMA”) and the Bond Dealers of America (“BDA”). The letter points out that “[t]he rule on its face does not distinguish between types of securities, other than municipal securities, which Rule 15c2-11expressly excepts.”

That is: Rule 15c2-11 applies to over-the-counter bonds as well as to over-the-counter stocks. Most fixed income securities—according to the BDA, “virtually all”—trade OTC, and the fixed income securities market is enormous. Michael Decker, the BDA’s senior vice president of federal policy and research, told Chappatta, “Until April of this year, I’ve never paid attention to this rule because this was not a fixed-income rule. The SEC has now taken the position that the rule already applies to fixed income and has always applied.”

SEC Surpasses $1 Billion in Total Whistleblower Awards

On September 15, 2021, the Securities and Exchange Commission (the “SEC”) awarded approximately $110 million to a whistleblower whose information and assistance led to successful SEC and related actions.

With the award, the SEC’s whistleblower program has now paid more than $1 billion in awards to 209 whistleblowers, including over $500 million in fiscal year 2021 alone.

The $110 million award stands as the second-highest award in the program’s history, following the over $114 million whistleblower award the SEC issued in October 2020.

SEC Charges Attorney Frederick Bauman with Participation in IIIegal, Unregistered Securities Offerings

On September 8, 2021, the Securities and Exchange Commission (the “SEC”) charged Nevada resident Frederick Bauman with playing a critical role as an attorney who facilitated the unregistered sale of millions of shares of securities by two groups engaged in securities fraud.

According to the SEC’s complaint, between 2016 and August 2019, Bauman authored at least a dozen legal opinion letters falsely stating that certain shareholders were not affiliated with the public companies whose stock they held. The complaint alleges that, in reality, the public companies and shareholders were under common control, and the shareholders were, therefore, affiliates of the companies.

Stock held by an affiliate of a public company is restricted, and only small quantities of such stock can be legally offered or sold to the public without a securities registration statement in effect. A registration statement contains important information about a public company’s business operations, financial condition, results of operation, risk factors, and management.

According to the complaint, Bauman provided the opinion letters to transfer agents. The transfer agents then allegedly relied on Bauman’s false letters in treating shares of stock as unrestricted and recording transfers on that basis. The SEC alleges that Bauman’s letters thus facilitated sales of millions of shares that could not legally be sold to the public without a registration statement.

SEC Files Subpoena Enforcement Action Against Alexander Kon

On September 1, 2021, the Securities and Exchange Commission announced that it filed an action against Alexander Kon, a penny stock promoter and resident of Overland Park, Kansas, seeking an order directing him to comply with investigative subpoenas for documents and testimony.

According to the SEC’s filing in U.S. District Court for the Southern District of Florida, the SEC is investigating whether Kon violated the federal securities laws by participating in an offering of penny stock in contravention of an SEC order.

Kon was previously named in an SEC Order on November 14, 2016, for his involvement in a 2014 stock promotion for Cannabusiness Group Inc (CBGI).

A Tale of Two Unregistered Dealers – Toxic Convertible Note Lenders Under SEC Scrutiny

In 2020, the Securities and Exchange Commission (the “SEC”) stepped up its efforts to reel in “toxic lenders”: individuals who profit enormously by buying convertible securities in penny stock companies and selling the shares they obtain upon conversion of their promissory notes, warrants or preferred stock.

Since those conversions usually take place at a considerable discount to market price, as tranche after tranche is sold, the stock price plummets and shares outstanding soar. Investors flee the staggering dilution, scrambling to get out before a big reverse split becomes inevitable. The companies themselves are doomed unless management can find a way to break the vicious cycle caused by the toxic lenders.

The SEC once had difficulty dealing with toxic lenders. The lenders insisted they were engaged in lawful business. They had contractual relationships with the issuers from whom they purchased notes, and the parties involved were merely acting in accordance with the terms of those contracts, they claimed. For a while, the regulator had some success alleging that in order to sell the stock they obtained through conversion, certain lenders illegally relied on a provision of Regulation D, Rule 504 that granted an exemption from registration under the blue sky laws in force in some states. They sued Edward Bronson and his firm E-Lionheart (d/b/a Fairhills Capital) on those grounds in 2012; in the following year, Curt Kramer and his Mazuma companies agreed to settle a similar action. But Bronson, Kramer, and others like them altered their methods and were soon back in business.

The SEC needed a new approach, and in 2017, it found one. It charged Ibrahim Almagarby and his Microcap Equity Group (MEG) with acting as unregistered dealers. The Securities Exchange Act of 1934 (Exchange Act) defines a dealer as “any person engaged in the business of buying and selling securities for his own account, through a broker or otherwise.”

That naturally sounds like a description of a normal retail investor, so there’s an exception for “traders,” who buy and sell for their own accounts, “but not as part of a regular business.”

Anyone who fits the definition of a “dealer” must register with the SEC and FINRA. Failure to do so constitutes a violation of the securities laws. In 2008, the SEC produced a Guide to Broker-Dealer Registration that clearly explains who may need to register.

SEC Whistleblower – Dodd Frank Revisions to be Proposed

On August 2, 2021, Gary Gensler, the new chair of the Securities and Exchange Commission (SEC), announced that because he wasn’t entirely pleased with the amendments to the rules governing the agency’s whistleblower program that became final in September 2020, he had:

… directed the staff to prepare for the Commission’s consideration later this year potential revisions to these two rules that would address the concerns that these recent amendments would discourage whistleblowers from coming forward. In particular, the staff is considering whether our rules should be revised to permit the Commission to make awards for related actions that might otherwise be covered by an alternative whistleblower program that is not comparable to the SEC’s own program and to clarify that the Commission will not lower an award based on its dollar amount.

Gensler’s feelings about the recent amendments to the whistleblower rules were already known; only a few days before, he’d delivered brief remarks at the National Whistleblower Center’s National Whistleblower Day 2021 celebration in which he alluded to his plans.

He also pointed out that the program was of particular interest to him because when the Dodd-Frank Act provided for its creation in 2010, he’d been chair of the Commodity Futures Trading Commission (CFTC) and had worked on setting up the whistleblower program there.

SEC Charges Unregistered Dealers Alexander Dillon, Cosmin Panait, Larry Adams and Salvador Rosillo

On Friday, August 13th, the Securities and Exchange Commission (the “SEC”) filed charges against GPL Ventures LLC, GPL Management LLC, Alexander J. Dillon, Cosmin I. Panait (the “GPL Defendants”), HempAmericana, Inc, Salvador E. Rosillo, Seaside Advisors, LLC, and Lawrence B. Adams (aka Larry Adams).

Dillon, a 32-year-old resident of New Jersey, and Panait, a 35-year-old New York resident and Romanian citizen, co-own and control GPL Ventures LLC and GPL Management LLC. The duo also co-own and controls Blackbridge Capital LLC, a toxic lending company mirroring GPL Ventures.

Lawrence Adams, a 66-year-old New Jersey resident, owns Seaside Advisors LLC, a New Jersey entity that touts itself as a consulting firm that helps public companies find favorable funding.

The SEC Complaint alleges that since 2017, the GPL Defendants have been operating as unregistered dealers by privately acquiring large blocks of stock in approximately 140 microcap issuers and publicly selling those blocks into the market for their own account, generating gross proceeds of at least $81 million.

Emerging Growth Company Status and the Going Public Process

Going public offers many benefits to companies seeking to grow their business, including:

- Enhanced ability to raise capital,

- Liquidity for founders and shareholders,

- Increased visibility

- Improved financial position,

- Enhanced credibility,

- Enhanced ability to attract and retain employees and

- The ability to offer valuable incentives to employees and consultants.

An Emerging Growth Company is defined as an issuer with total annual gross revenues of less than $1.07 billion during its most recently completed fiscal year. Status as an Emerging Growth Company offers many benefits to issuers going public. Most companies quoted on the OTC Markets OTC Link qualify as Emerging Growth Companies.

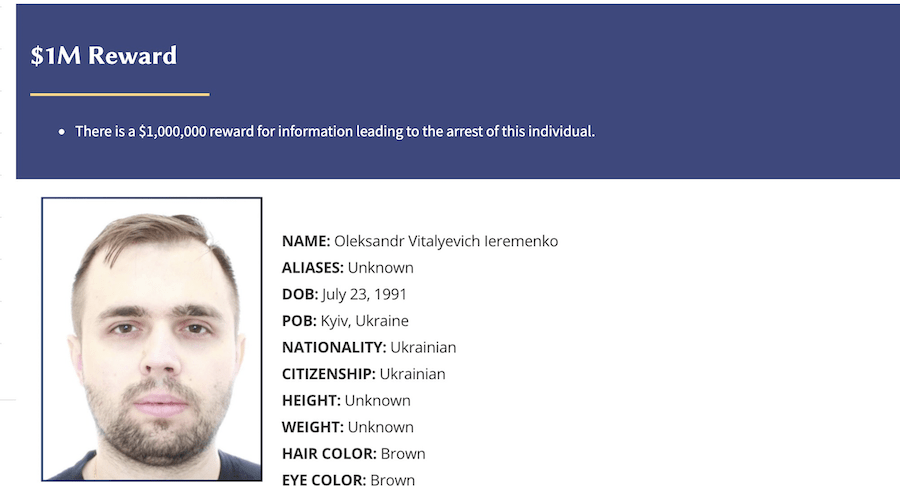

SEC Obtains Default Judgment in Edgar Hacking Case

On July 29, 2021, the United States District Court for the District of New Jersey entered a default judgment against Oleksandr Ieremenko and Andrey Sarafanov, who were charged in connection with a scheme to trade on nonpublic earnings information hacked from the SEC’s EDGAR system.

The SEC’s complaint alleged that Ieremenko, a Ukrainian hacker, gained access to EDGAR in 2016 and extracted EDGAR filings containing nonpublic earnings results.

The information in the filings was allegedly passed to individuals, including Sarafanov, who used it to trade in the narrow window between when the files were extracted from SEC systems and when the companies released the information to the public.

In total, eight traders allegedly traded before at least 157 earnings releases from May to October 2016 and generated at least $4.1 million in illegal profits. According to the complaint, Sarafanov’s trading on hacked information resulted in profits of $1,094,435.

Understanding the September 28 Amended Rule 15c2-11 Deadline

As the summer of 2021 enters its final months, investors in the U.S. over-the-counter market and OTC issuers themselves await the rollout of the amended Securities and Exchange Commission (“SEC”) Rule 15c2-11 on September 28. The rule is vital to the penny stock market: no OTC security can begin trading until a market maker sponsors it by filing a Form 211 with the Financial Industry Regulatory Authority (“FINRA”). Once the form is processed, the sponsoring market maker can request a trading symbol and begin to quote the stock. For 30 days, he has exclusive rights to market making in that issue; subsequently, additional market makers may join in without filing their own Forms 211. That is known as the Piggyback Exception.

Why Is a New Rule Needed?

Rule 15c2-11 was introduced in 1971 and was last substantially modified in 1991. Since then, the OTC Market has changed dramatically, largely thanks to the rise of the internet. By 1995, inexpensive online trading was readily available; the high commissions that had once discouraged frequent trading disappeared. The Pink Sheets and the OTCBB, once-sleepy backwaters, turned into gold rush towns crowded with gamblers willing to take a chance on the latest can’t-miss play. Microcap fraud increased by leaps and bounds. Read More

SEC Pursues Unregistered Dealers, Toxic Financing, Toxic Convertible Notes

2020 and 2021 have been historic years for Securities and Exchange Commission (“SEC”) enforcement action against toxic lenders as unregistered dealers. We recently wrote about the interesting SEC enforcement actions that examine toxic financings and the question of whether the individuals and entities that purchase convertible promissory notes from public companies are “dealers” according to the definition established in Section 15(a)(1) of the Securities and Exchange Act of 1934 (“Exchange Act”).

Informally known as “toxic lenders” or “dilution funders” because the terms of their financing agreements contain provisions that almost always result in harm to investors and issuers alike, they’re considered by many to be the scourge of the penny stock market. Typically, the notes they buy can be converted at any time, often at a discount to market price of 70 percent or more. As the lender converts and sells, stock price drops. To avoid making insider filings to the SEC, the lender’s financing agreements specify that he may own no more than 4.99 percent of the company’s stock at any time. But that in no way stops him from converting his note continuously, in a succession of tranches. Since the conversion ratio is pegged to the security’s recent average bid price, every time he converts, he gets more stock than the time before. As he sells tranche after tranche, the company’s stock price enters freefall. Sometimes the only remedy for the issuer is a large reverse split.

Read More

SEC charges former Nikola CEO with securities fraud

On July 29th, the Securities and Exchange Commission (the “SEC”) announced charges against Trevor R. Milton, the founder, former CEO and former executive chairman of Nikola Corporation, for repeatedly disseminating false and misleading information – typically by speaking directly to investors through social media – about Nikola’s products and technological accomplishments.

The SEC’s complaint, filed in U.S. District Court for the Southern District of New York, alleges that Milton founded Nikola in 2015 with the primary goal of manufacturing trucks that run on alternative fuels with low or zero emissions and building an alternative fuel station infrastructure to support those vehicles.

Milton allegedly helped Nikola raise more than $1 billion in private offerings and go public through a business combination conducted by a special purpose acquisition company (SPAC).

SEC Charges Charlie Abujudeh in Microcap Fraud Scheme Targeting Retail Investors

On July 22, 2021, the Securities and Exchange Commission (the “SEC”) filed an emergency action charging California resident Charlie Abujudeh with running microcap fraud schemes targeting retail investors.

According to the SEC’s complaint, filed in the U.S. District Court for the Eastern District of New York, Abujudeh worked with others from August 2019 to at least September 2020 to fraudulently sell several microcap companies’ stock to investors by making misleading statements during high-pressure sales calls and/or email promotions.

SEC charges Marlon Muller with stock manipulation

On July 15th, the Securities and Exchange Commission (the “SEC”) announced charges against Marlon Muller for engaging in a pattern of coordinated trading intended to artificially raise and sustain the price of microcap issuer EMS Find, Inc. (EMSF) and to generate liquidity.

The SEC’s complaint, filed in the United States District Court for the Southern District of New York, alleges that using an internet chat application Muller repeatedly instructed an associate when and how to submit buy and sell orders for EMSF shares, using several brokerage accounts the associate controlled at multiple broker-dealers, in order to reach the price and liquidity levels Muller wanted.

This manipulative trading activity allegedly distorted the true value of EMSF shares as well as the actual market interest in EMSF and operated as a fraud on the investing public.

According to the complaint, from June until September 2015, Muller received compensation from the associate as well as payments from another entity trading EMSF shares, totaling over $300,000.