SEC Charges Convertible Note Dealer, BHP Capital NY Inc, and Its Owner, Bryan Pantofel, for Failure to Register

On Thursday, June 16, 2023, the Securities and Exchange Commission (the “SEC”) announced settled charges against a convertible note dealer, BHP Capital NY, Inc., and its managing member, Bryan Pantofel, for failing to register with the SEC as securities dealers.

As part of the settlement, Pantofel and BHP Capital agreed to pay more than $2.5 million in monetary relief and have BHP Capital surrender for cancellation the securities it allegedly obtained from its unregistered dealer activity.

The SEC’s complaint, filed in the U.S. District Court for the Southern District of Florida, alleges that, between December 2017 and mid-2022, BHP Capital purchased more than 100 convertible notes and associated warrants from 47 microcap issuers, and converted the notes into approximately four billion newly issued shares of stock at a large discount from the market price. It then allegedly sold the newly issued shares into the market at a significant profit.

As alleged, neither BHP Capital nor Pantofel was registered as a dealer with the SEC or associated with a registered dealer, as their activities required them to be.

According to the SEC, the notes typically had: (a) a nine-month to one-year maturity date; (b) principal amounts between $6,333 and $315,000; (c) interest rates around 10%; and (d) steep prepayment penalties. And the notes’ conversion terms also significantly favored BHP Capital, allowing the company, in its sole discretion, to convert the debt into common stock at a 20% to 50% discount to the prevailing market price after the Rule 144 holding period lapsed. Most of the notes also contained original issue discounts, which entitled BHP Capital to convert the note to stock or be repaid with interest based on the face amount of the note rather than on the discounted price BHP Capital paid for it.

The SEC further detailed that BHP Capital’s repeated conversion of notes and warrants and sale of newly issued shares not only increased the number of issued and outstanding shares but also increased each issuer’s public float—namely, the shares in the hands of public investors. As a result, BHP Capital’s sales diluted the equity positions of existing shareholders and often depressed the price of issuers’ stock.

For example:

- On or about July 30, 2019, BHP Capital entered into a convertible promissory note with EWellness Healthcare Corp. (“EWLL”). The convertible promissory note had a net principal amount of $38,500 and an original issue discount of $3,500. BHP Capital began converting the note just after the holding period ended on February 7, 2020, at a 35% discount from the market price. Over the next seven weeks, BHP Capital executed an additional eleven conversions on this note and was issued a total of 120,522,485 shares. BHP Capital sold all of these shares into the market, within one to three days of conversion, at a substantial profit.

- On or about September 3, 2019, BHP Capital entered into a convertible promissory note and associated warrant with Kinerjapay Corp. (“KPAY”), with a net principal amount of $82,500 and an original issue discount of $7,500. BHP Capital began converting the note just after the holding period ended on March 6, 2020, at a 35% discount from the market price. Over the next six weeks, BHP Capital executed an additional five conversions on this note and was issued a total of 125,643,363 shares. BHP Capital sold all of these shares into the market, in all cases within days of conversion, for substantial profits.

- On or about October 30, 2019, BHP Capital entered into a convertible promissory note with HealthLynked Corp. (“HLYK”), with a net principal amount of $108,947.37, and an original issue discount of $5,447.37. BHP began converting the note just after the holding period ended on May 1, 2020, at a 25% discount from the market price. BHP Capital executed two additional conversions on the note and was issued a total of 1,954,870 shares. BHP Capital sold all of these shares into the market, within days of each conversion, which resulted in a substantial profit.

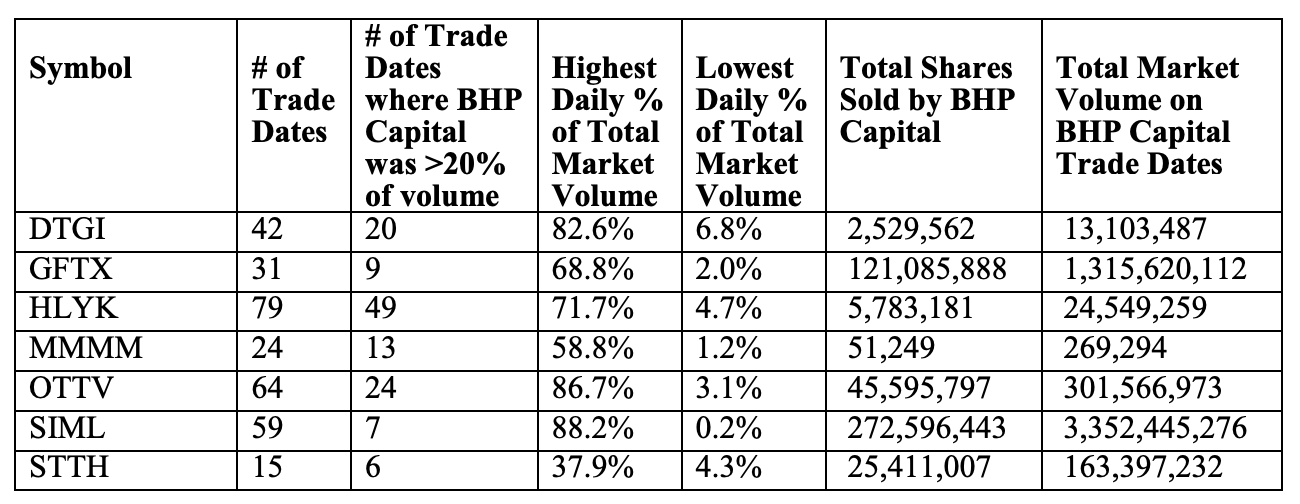

Further, BHP Capital’s sales of post-conversion shares frequently were a material percentage of the volume of total trades on the days they traded. For instance, BHP Capital’s sales volumes as a percentage of the overall market volume on the days they traded the following seven penny stocks during the Relevant Period are as follows:

Without admitting or denying the allegations, BHP Capital and Pantofel agreed to be permanently enjoined from further violations of Section 15(a)(1) of the Securities Exchange Act of 1934, to pay disgorgement and prejudgment interest of $2,353,073.44 and a civil penalty of $200,000, and to five-year penny stock bars. BHP Capital also agreed to surrender all conversion rights in its currently held convertible notes, surrender for cancellation all unexercised warrants that it acquired in connection with convertible notes, and surrender for cancellation any shares it holds that were acquired by converting notes or exercising related warrants. The settlement is subject to court approval.

A search of SEC filings shows that BHP Capital NY Inc did financing agreements with the following Issuers:

Integrated Ventures Inc (INTV), Vinco Ventures Inc (BBIG), Chineseinvestors.com Inc (fka CIIX), Resonate Blends Inc (KOAN), FuboTV Inc (FUBO), Healthlynked Corp (HLYK), BIMI International Medical Inc (BIMI), Generex Biotechnology Corp (fka GNBT), American Battery Metals Corp (BLTH), Pharmagreen Biotech Inc (PHBI), Marijuana Company of America Inc (MCOA), Digerati Technologies Inc (DTGI), Tauriga Sciences Inc (TAUG), SurgePays Inc (SURG), Ionix Technology Inc (IINX), American International Holdings Corp (AMIH), RemSleep Holdings Inc (RMSL), Sylios Corp (fka UNGS), Mirage Energy Corp (MRGE), Stealth Technologies Inc (fka STTH), KinerjaPay Corp (fka KPAY), BrewBilt Brewing Co (BRBL), Mitesco Inc (MITI), Creative Medical Technology Holdings Inc (CELZ), Quad M Solutions Inc (MMMM), Hemp Naturals Inc (HPMM), Optec International Inc (OPTI), FTE Networks Inc (fka FTNW), Yangtze River Port & Logistics (YRIV), Authentic Holdings Inc (AHRO), Cannabis Global Inc (CBGL), Cannapharmarx Inc (CPMD), Eightco Holdings Inc (OCTO), Dais Corporation (DLYT), Deep Green Waste & Recycling Inc (DGWR), Viva Entertainment Group Inc (OTTV), CarbonMeta Technologies Inc (COWI), GEX Management Inc (GXXM), Probility Media Corp (PBYA), iQSTEL Inc (IQST), NaturalShrimp Inc (SHMP), Touchpoint Group Holdings Inc (TGHI), Quatum Computing Inc (QUBT), and EWellness Healthcare Corp (EWLL).

It isn’t clear yet in which Issuers BHP Capital still owns securities, but we’ll keep an eye out for the settlement agreement to get presented to the court, which should include a list of all remaining securities owned by BHP Capital slated to be canceled.

To speak with a Securities Attorney, please contact Brenda Hamilton at 200 E Palmetto Rd, Suite 103, Boca Raton, Florida, (561) 416-8956, or by email at [email protected]. This securities law blog post is provided as a general informational service to clients and friends of Hamilton & Associates Law Group and should not be construed as and does not constitute legal advice on any specific matter, nor does this message create an attorney-client relationship. Please note that the prior results discussed herein do not guarantee similar outcomes.

Hamilton & Associates | Securities Attorneys

Brenda Hamilton, Securities Attorney

200 E Palmetto Rd, Suite 103

Boca Raton, Florida 33432

Telephone: (561) 416-8956

Facsimile: (561) 416-2855

www.SecuritiesLawyer101.com