SEC Charges Kim Kardashian with Violating Section 17(b)

On October 3, 2022, the SEC Division of Enforcement entered into a settlement of charges with Kimberly Kardashian (“Kardashian” or “Respondent”).

The SEC Offer of Settlement (the “Offer”) includes findings that:

- On June 13, 2021, Kim Kardashian—a well-known media personality and businesswoman—touted a crypto asset security on social media that was being offered and sold. Kardashian did not disclose that she was being compensated for giving such security publicity by the entity offering and selling the security.

- Kardashian’s failure to disclose this compensation violated Section 17(b) of the Securities Act, which makes it unlawful for any person to promote a security without fully disclosing the receipt and amount of such consideration from an issuer.

According to the Order, Kim Kardashian promoted a crypto asset security on her Instagram account in exchange for financial payment from the issuer. Kardashian received approximately $250,000 for this promotion. At the time of her promotion, Kardashian had approximately 225 million Instagram followers.

Specifically, Kardashian promoted a securities offering conducted by EthereumMax, an online company with a public website (“EthereumMax” or the “Company”), in which it offered and sold digital “Emax tokens” (“EMAX”) to the general public. The EMAX tokens promoted by Kardashian were offered and sold as investment contracts and, therefore, securities pursuant to Section 2(a)(1) of the Securities Act. Starting on approximately May 14, 2021, EthereumMax made the EMAX tokens available for public trading on a “decentralized” crypto asset trading platform.

Based on EthereumMax’s marketing materials, as well as public statements by EthereumMax affiliates, the EtherumMax website, and EthereumMax social media handles, purchasers of EMAX tokens would have had a reasonable expectation of profits from their investment in the tokens. EthereumMax frequently touted the token’s rise in price on its social media pages as it offered and sold EMAX tokens.

Based on EthereumMax’s public statements, purchasers of the EMAX tokens would have had a reasonable expectation that EthereumMax and its agents would expend significant efforts to develop the EthereumMax platform, which would increase the value of their EMAX tokens, resulting in investor profit. EthereumMax’s marketing materials highlighted that the Company and its agents would ensure a secondary trading market for EMAX tokens by creating a trading market for EMAX tokens. EthereumMax’s marketing materials also emphasized the purported expertise of the Company’s management.

Moreover, EthereumMax’s marketing materials contained numerous direct statements that the EMAX tokens would rise in value as a result of the efforts of the Company and its agents, including by touting future deals and relationships that would “drive value.” EthereumMax also promised to develop certain “token enhancements,” including “additional tokenomics to enhance economic value,” future rewards and staking programs, national sporting and event partnerships, and a general expansion of the EMAX token ecosystem.

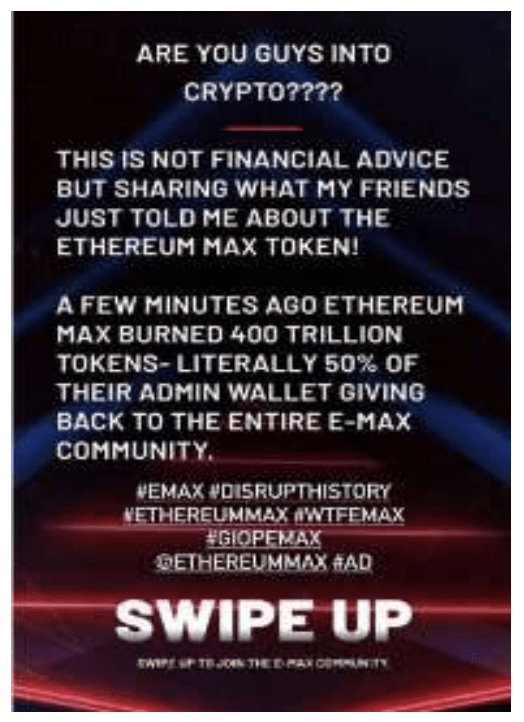

Kardashian promoted EthereumMax’s offering on social media by posting the following to her Instagram account on June 13, 2021, along with an introductory video stating she had a “big announcement.”

Kim Kardashian’s post contained a link to the EthereumMax website, where instructions were provided for potential investors to purchase EMAX tokens. Kardashian also included #AD at the bottom of the post. EthereumMax, through an intermediary, paid Kardashian $250,000 for this promotion. Kardashian did not disclose that she had been paid by EthereumMax or the amount of compensation she received from EthereumMax for making this post.

Kardashian’s crypto asset security promotion occurred after the Commission warned in its July 25, 2017, DAO Report of Investigation that digital tokens or coins offered and sold may be securities, and those who offer and sell securities in the United States must comply with the federal securities laws. The promotion also occurred nearly four years after the Commission’s Division of Enforcement and Office of Compliance Inspections and Examinations issued a statement reminding market participants that “[a]ny celebrity or other individual who promotes a virtual token or coin that is a security must disclose the nature, scope, and amount of compensation received in exchange for the promotion. A failure to disclose this information is a violation of the anti-touting provisions of the federal securities laws.”

Section 17(b) of the Securities Act makes it unlawful for any person to:

“publish, give publicity to, or circulate any notice, circular, advertisement, newspaper, article, letter, investment service, or communication which, though not purporting to offer a security for sale, describes such security for a consideration received or to be received, directly or indirectly, from an issuer, underwriter, or dealer, without fully disclosing the receipt, whether past or prospective, of such consideration and the amount thereof. “

According to the SEC, Kardashian violated Section 17(b) of the Securities Act by touting the EMAX token sale on her social media account without disclosing that she received compensation from the issuer for doing so and the amount of the consideration.

As part of the settlement, Kim Kardashian has undertaken:

- for a period of three (3) years from the date of this Order, forgo receiving or agreeing to receive any form of compensation or consideration, directly or indirectly, from any issuer, underwriter, or dealer, for directly or indirectly publishing, giving publicity to, or circulating any notice, circular, advertisement, newspaper, article, letter, investment service, or communication which, though not purporting to offer a crypto asset security for sale, describes such crypto asset security; and

- continue to cooperate with the Commission’s investigation in this matter.

Pursuant to Section 8A of the Securities Act, Respondent cease and desist from committing or causing any violations and any future violations of Section 17(b) of the Securities Act. Kardashian was also ordered to pay disgorgement of $250,000, prejudgment interest of $10,415.35, and a civil money penalty in the amount of $1,000,000 to the Securities and Exchange Commission.

To speak with a Securities Attorney about going public or SEC Registration Statements on Form S-1, please contact Brenda Hamilton at 200 E Palmetto Rd, Suite 103, Boca Raton, Florida, (561) 416-8956, or by email at [email protected]. This securities law blog post is provided as a general informational service to clients and friends of Hamilton & Associates Law Group and should not be construed as and does not constitute legal advice on any specific matter, nor does this message create an attorney-client relationship. Please note that the prior results discussed herein do not guarantee similar outcomes.

Hamilton & Associates | Securities Attorneys

Brenda Hamilton, Securities Attorney

200 E Palmetto Rd, Suite 103

Boca Raton, Florida 33432

Telephone: (561) 416-8956

Facsimile: (561) 416-2855

www.SecuritiesLawyer101.com