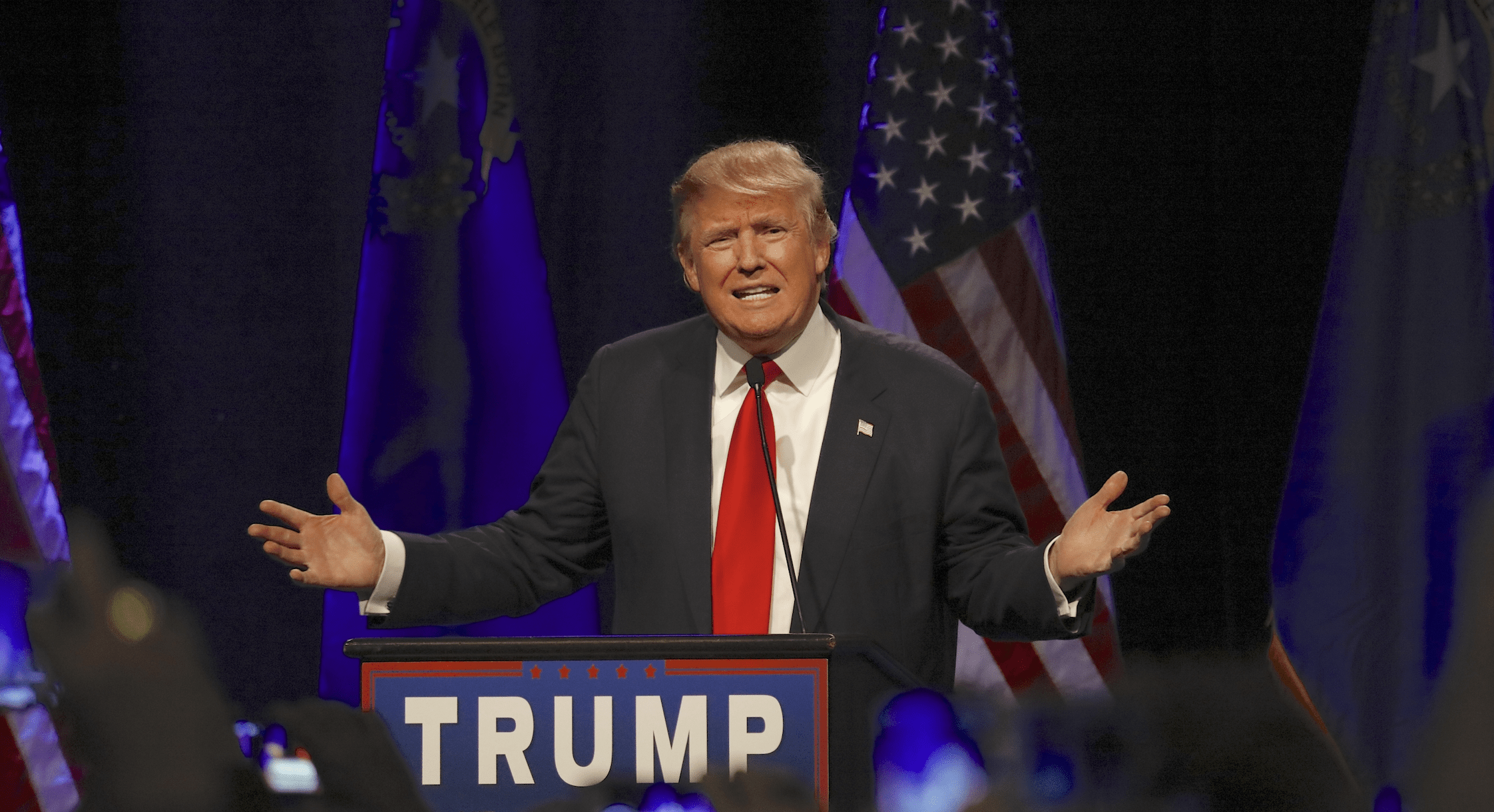

SEC permanently bans BF Borgers and its owner Benjamin Borgers and fines them a combined $14 million for accounting fraud

On May 3, 2024, the Securities and Exchange Commission (the “SEC“) charged audit firm BF Borgers and Its owner, Benjamin F. Borgers (together, “Respondents”), with Massive Fraud affecting more than 1,500 SEC filings. The SEC found that Borgers committed deliberate and systemic failures to comply with Public Company Accounting Oversight Board (PCAOB) standards in its audits and reviews incorporated in more than 1,500 SEC filings from January 2021 through June 2023.

The SEC also charged the Respondents with falsely representing to their clients that the firm’s work would comply with PCAOB standards; fabricating audit documentation to make it appear that the firm’s work did comply with PCAOB standards; and falsely stating in audit reports included in more than 500 public company SEC filings that the firm’s audits complied with PCAOB standards.

According to the Order against the Respondents, from January 2021 through June 2023, BF Borgers had 350 clients who were required under the SEC’s rules and regulations to have their financial statements audited and/or reviewed by a PCAOB-registered accounting firm in accordance with PCAOB standards and to incorporate those financial statements into filings made with the SEC. Read More

SEC Nails BF Borgers and Ben Borgers – Issuers Must Obtain New Auditors

On May 3, 2024, the Securities and Exchange Commission provided a statement for issuers impacted by its enforcement action against BF Bofgers CPA PC. According to the SEC Action against BF Borgers, approximately 500 issuers used the services of BF Borgers for their audits between January 2021 through June 2023.

On May 3, 2024, the SEC entered an order instituting settled administrative and cease-and-desist proceedings[2] against BF Borgers CPA PC and its sole audit partner Benjamin F. Borgers CPA (individually and together, “BF Borgers”), finding that, among other things, BF Borgers:

- deliberately and systematically failed to conduct audits and quarterly reviews in accordance with applicable Public Company Accounting Oversight Board (“PCAOB”) standards;

- fraudulently issued audit reports that falsely represented that audits had been performed in accordance with PCAOB standards; and

- caused audit clients to violate certain provisions of the Exchange Act and rules thereunder, including Exchange Act Sections 13(a) and 15(d).

The Order denies BF Borgers the privilege of appearing or practicing before the Commission as an accountant. As a result, BF Borgers may not participate in or perform the audit or review of financial information included in Commission filings, issue audit reports included in Commission filings, provide consents with respect to audit reports, or otherwise appear or practice before the Commission.

A significant number of issuers will be impacted by the Order against Borgers. The SEC statement was issued to assist issuers in complying with their disclosure and reporting obligations in light of the Order involving BF Borgers. We encourage all issuers that have previously engaged BF Borgers as their independent auditor to consider the findings and sanctions discussed in the Order, taking into account their disclosure obligations under the federal securities laws. Read More

What are SEC Periodic Reporting Requirements? Securities Lawyer 101

Companies become subject to the SEC’s periodic reporting requirements in several ways, including by filing a registration under the Securities Act of 1933, as amended or pursuant to the Securities Exchange Act of 1934. The SEC’s periodic reporting rules require that publicly traded companies disclose a wealth of information to the public. Periodic reporting also requires that these reports be written in plain English. Understanding these reports helps investors make informed decisions regarding whether to buy, sell or hold a company’s securities.

Periodic reports serve as a platform for issuers to provide shareholders with transparency by sharing their stories. However, it’s important to note that companies that provide materially false or misleading statements or omit material information necessary to render a report not misleading in their periodic reports can face serious liabilities under federal and state securities laws. Investors can access a company’s Form 10-K, Form 10-Q and Form 8-K filings on the SEC’s EDGAR database to ensure they are well-informed. Read More

Reg A+ Securities Offerings and FAST Act

Prospective For Underwriters & Broker-Dealers: Due Diligence Considerations

Unlike traditional Initial Public Offerings (“IPOs”), there is no potential liability for issuers under Section 11 of the Securities Act in connection with Regulation A+ offerings. Sellers in Regulation A+ offerings are potentially liable under Section 12(a)(2) of the Securities Act for materially misleading statements in the offering circular or in oral communications. Accordingly, the potential Securities Act liability of issuers under a Regulation A+ offering is less than in connection with a Rule 506 offering but greater than in connection with an IPO.

As such, underwriters and broker-dealers participating in a Regulation A+ offering should require a level of due diligence and disclosure comparable to that of offerings registered with the Securities & Exchange Commission (“SEC”).

Tier I and Tier II offerings will be subject to review by the Financial Industry Regulatory Authority (“FINRA”) if broker-dealers participate in the Regulation A+ offering. Read More

DTC Eligibility Q&A

The Depository Trust and Clearing Corporation (“DTCC”), through its subsidiaries, provides clearing, settlement and information services for securities. DTCC’s subsidiary, the Depository Trust Company (“DTC”), was created to improve efficiencies and reduce risk in the clearance and settlement of securities transactions. Not all securities are eligible to be settled through DTC. DTC eligibility has often become an unexpected burden for companies in going public transactions.

Issuers must satisfy the criteria set by DTCC to be settled through DTC. All companies must satisfy this criteria in order to be DTC eligible, including both Securities and Exchange Commission (“SEC”) reporting and non-reporting issuers. This presentation discusses the most common questions we receive about DTC eligibility has become a growing concern in going public transactions. Read More

Form S-1 Registration, Filing and Requirements, Form S-1 and Going Public Lawyers

Private companies going public should consider Form S-1 filing requirements when contemplating their securities offering. Private companies seeking to raise capital often file a registration statement on SEC Form S-1 to meet certain requirements of the Financial Industry Regulatory Authority when going public. Upon filing, a Form S-1 is reviewed by the Securities and Exchange Commission, who may render SEC Comments. Once a Form S-1 is declared effective by the SEC, the company becomes subject to SEC reporting requirements.

All companies qualify to use and must comply with Form S-1 registration statement requirements. Unlike a Form 10 registration statement, which registers a class of securities, Form S-1 registers specific securities offerings or transactions and it does not become effective until all SEC comments have been resolved. Read More

Form 10 Registration Statements Q & A

Form 10 is a Registration Statement used to register a class of securities pursuant to Section 12(g) of the Securities Exchange Act of 1934 (“Exchange Act”). This article addresses common questions we receive from clients about Form 10 registration statements. Read More

Hamilton & Associates Law Group: Regulation A+ White Paper

Regulation A+

White Paper

www.securitieslawyer101.com

www.securitieslawyer101.com

This publication is intended to provide information of general interest to the public and is not intended to offer legal advice about specific situations or problems. Hamilton & Associates Law Group, P.A. does not intend to create an attorney-client relationship by offering this information about Regulation A+, and your reliance on the information presented in this publication does not create such a relationship. You should consult a lawyer if you need legal advice regarding a specific situation or problem. © 2024 Hamilton & Associates Law Group, P.A.

A copy of this White Paper can be found at the following link:

https://www.securitieslawyer101.com/wp-content/uploads/2024/03/Reg-A-White-Paper-.pdf Read More

Toxic Funders: Unregistered Dealers, Short Sellers, or Both?

We’ve often written about “toxic” promissory notes or preferred stock and the unregistered dealers who purchase them. These dealers are not the broker-dealers ordinary retail investors have accounts with. They are individuals with companies of their own that they use to provide financing to mostly microcap companies desperate for cash. In the long run, these financings almost always prove deadly for the issuers because of the way they are structured.

Initially, the company turns to a “toxic funder” or “dilution funder” for money. The company may even be solicited by a boiler room set up by one or more of these people. Like payday loan sharks, they seek out vulnerable CEOs whose companies aren’t gaining the traction they need to survive and offer them deals.

The deals are not good for the company or for the investors it already has. The funder will sometimes have done research in advance. If not, he’ll ask company management how much money is needed, and then he’ll draw up a stock purchase agreement or securities purchase agreement. He won’t be buying actual stock; instead, he’ll purchase a promissory note, preferred stock, or even a debenture. Whatever the instrument, it will be convertible to the issuer’s common stock. The terms of conversion will be explained in the securities purchase agreement and in the note itself. Read More

2024 Form 10K and 10-K Deadlines Chart

| Periodic Report | Large Accelerated Filers | Accelerated Filers | Non-Accelerated Filers |

| Form 10-K for Fiscal Year Ended December 31, 2023 | February 29, 2024 | March 15, 2024 | April 1, 2024 |

| Form 10-Q for Fiscal Quarter Ended March 31, 2024 | May 10, 2024 | May 10, 2024 | May 15, 2024 |

| Form 10-Q for Fiscal Quarter Ended June 30, 2024 | August 9, 2024 | August 9, 2024 | August 14, 2024 |

| Form 10-Q for Fiscal Quarter Ended June 30, 2024 | November 12, 2024 | November 12, 2024 | November 14, 2024 |

Rule 144 Legal Opinions and Legend Removal Q&A

Section 5 of the Securities Act of 1933, as amended, (the “Securities Act”) requires the offer and sale of securities to be registered under the Securities Act, unless the security or transaction qualifies for an exemption from registration. Rule 144 of the Securities Act provides a safe harbor that permits holders of “restricted securities” to resell their securities in the public market if specific conditions are met. To resell restricted securities, the Company’s transfer agent will require a legal opinion as to the tradability of the shares. The legal opinion will discuss the resell exemption relied upon for the resale of the shares. Most often, this will be Rule 144.

This blog post discusses the most common questions we receive about Rule 144’s Safe Harbor. Read More

SEC Consent Judgments: Speak Now, or Forever Hold Your Peace

Most investors are likely unaware that they can petition the SEC for new rules or changes to old ones. They can even ask that rules be entirely repealed. All that’s needed is to send a proposal to the secretary of the SEC—now Vanessa Countryman—and wait for results. Petitioners come from wildly different backgrounds. Most are lawyers (often representing individuals or entities that have been sued by the Commission) or people who more broadly object to rules they believe to be unfair or even unconstitutional. For ordinary investors, objections to the “pattern day trading” rule, which is administered by FINRA, not the SEC, have long been popular—and even students occasionally weigh in. See the petition of Atticus Wong, a high school student in California, who wrote in connection with a class project about civic engagement.

The SEC explains the submission process simply:

Petitions must contain the text or substance of any proposed rule or amendment or specify the rule or portion of a rule requested to be repealed. Persons submitting petitions must also include a statement of their interest and/or reasons for requesting Commission action.

All petitions will be forwarded to the appropriate division or office of the Commission for consideration and recommendation. Following submission of the staff’s recommendation to the Commission, petitioners will be notified of any action taken by the Commission.

The agency will then post the petition on the appropriate page on its website, which is likely the last the petitioner will ever hear of it. Apparently, the Commission is not obliged to give serious consideration to any of the petitions it receives. When it responds at all, it usually does so only after years of delay, and the petitions graced by its acknowledgment are almost always denied. Read More

SEC Rules Affecting Rule 144 Legal Opinions and Shell Companies

The Securities and Exchange Commission (“SEC”) has published releases relating to Shell Companies that affect the use of Rule 144 of the Securities Act of 1933, as amended (the “Securities Act”), by shareholders of Shell Companies. In addition, the rules limit registration of securities on Form S-8 of the Securities Act and affect disclosures required in Form 8-K under the Securities Exchange Act of 1934, (the “Exchange Act”).

What is a Shell Company?

Securities Act Rule 405 and Exchange Act Rule 12b-2 define a Shell Company as a company, other than an asset-backed issuer, with no or nominal operations; and either:

- no or nominal assets;

- assets consisting of cash and cash equivalents; or

- assets consisting of any amount of cash and cash equivalents and nominal other assets.

SPAC Settles SEC Fraud and Conflict of Interest Charges

On January 25, 2024, the Securities and Exchange Commission announced that Northern Star Investment Corp. II, a special purpose acquisition company (SPAC), agreed to settle charges that it made misleading statements in forms filed with the SEC as part of its initial public offering (IPO).

According to the SEC’s order, Northern Star represented in its SEC filings that neither the company, nor anyone acting on its behalf, had initiated any substantive discussions with any potential target companies prior to the IPO. However, the SEC’s order finds that Northern Star had engaged in discussions with a target company and that company’s controlling shareholder in connection with a potential SPAC business combination dating back to December 2020 and continuing for several weeks. Furthermore, according to the SEC’s order, after announcing a merger agreement with the target company, Northern Star did not adequately disclose conflicts of interest related to its interactions with the target company in its Form S-4 filings. Read More

SEC Charges Founder of $1.7 Billion “HyperFund” Crypto Pyramid Scheme Xue Lee (aka Sam Lee) and Top Promoter Brenda Chunga (aka Bitcoin Beautee) with Fraud

On January 29, 2024, the Securities and Exchange Commission (the “SEC“) charged Xue Lee (aka Sam Lee) and Brenda Chunga (aka Bitcoin Beautee) for their involvement in a fraudulent crypto asset pyramid scheme known as HyperFund that raised more than $1.7 billion from investors worldwide.

According to the SEC’s complaint, from June 2020 through early 2022, Lee and Chunga promoted HyperFund “membership” packages, which they claimed guaranteed investors high returns, including from HyperFund’s supposed crypto asset mining operations and associations with a Fortune 500 company. As the complaint alleges, however, Lee and Chunga knew or were reckless in not knowing that HyperFund was a pyramid scheme and had no real source of revenue other than funds received from investors. In 2022, the HyperFund scheme (which rebranded twice during its lifespan – from HyperFund to HyperVerse, then to HyperNation) collapsed and investors were no longer able to make withdrawals. Read More

SEC Charges Aryeh Goldstein, Adar Bays, LLC, and Adar Alef, LLC for Failure to Register; Defendants Agree to Pay $1.25 Million to Settle

On January 23, 2024, the Securities and Exchange Commission (the “SEC”) announced the filing of an enforcement action against Aryeh Goldstein, a resident of Florida and New York, and two entities he controls, Adar Bays, LLC, located in Florida, and Adar Alef, LLC, doing business in Florida and New York, for failing to register as securities dealers in connection with their convertible note financing business that involved obtaining and selling securities of over 100 microcap companies.

The parties have agreed to settle the charges. Among other relief, Goldstein and his entities agreed to pay $1.25 million in monetary relief and to surrender or cancel all remaining shares of public companies allegedly obtained from their unregistered dealer activity. Read More

Frederick L. Sharp, Luis Carrillo, Courtney M. Kelln, Mike K.G. Veldhuis, and Paul Sexton Indicted for Long-Running Pump-and-Dump Schemes

Four Canadian nationals and one former California attorney, who is believed to be residing in Mexico, were indicted on Jan. 9, 2024 in connection with long-running international securities fraud schemes in which they sold millions of shares in multiple microcap—or “penny”—stock companies during pump-and-dumps, generating at least tens of millions of dollars in illicit proceeds.

The indictment charged Frederick L. Sharp, 71, and Courtney M. Kelln, 43, both of British Columbia, with two counts each of securities fraud and conspiracy to commit securities fraud. The indictment further charged Luis Carrillo, 50, previously of California, and Mike K.G. Veldhuis, 43, and Paul Sexton, 55, both of British Columbia, with one count each of securities fraud and conspiracy to commit securities fraud.

Sharp, Carrillo, Veldhuis and Kelln were previously charged in a criminal complaint.

Also among the named co-conspirators was Roger Knox, who founded and ran the Swiss asset management firm Wintercap SA and who was sentenced for securities fraud and conspiracy to commit securities fraud in October 2023, and Richard Targett-Adams, who resided in France and worked for Knox. Targett-Adams was responsible for several back-office tasks for Wintercap. Read More

Aditya Raj Sharma Indicted for $10 million Investment Fraud

On January 12, 2024, the U.S. Attorney’s Office for the District of Minnesota announced Aditya Raj Sharma of Maple Grove, Minnesota, had been indicted for defrauding investors and financial institutions out of more than $10 million.

According to court documents, Aditya Raj Sharma, 50, was the founder, CEO, and president of Crosscode Inc., a cloud-based software development company headquartered first in Maple Grove and later in Foster City, California. From Crosscode’s founding in 2015 through at least May 2019, Sharma was the primary operator of the company, its controlling shareholder, and, at times, its only employee and shareholder.

According to court documents, from 2017 through at least 2019, Sharma knowingly and intentionally devised and executed a scheme to defraud investors, financial institutions, and lending and finance companies. Sharma manipulated and falsely inflated Crosscode’s financial records to induce private investors and financial entities to extend capital to his company in order to avoid or delay financial hardship for Crosscode, which was mired in debt with virtually no incoming revenue or cash-on-hand.

According to court documents, Sharma fraudulently applied for hundreds of thousands in funding from multiple lenders and finance companies as part of his multi-year scheme. In total, Sharma induced at least one financial institution to provide him with a $950,000 line of credit and further induced at least 150 investors, including Minnesotans, to provide approximately $9.25 million to Crosscode. Read More

FORM S-1 REGISTRATION STATEMENTS – WHAT COMPANIES NEED TO KNOW ABOUT FORM S-1 & GOING PUBLIC

Form S-1 Benefits & Going Public

When a company sells shares, the shares must be covered by an effective registration statement or exempt from the Securities & Exchange Commission’s registration statement requirements.

Form S-1 is the most commonly used registration statement form. The form offers flexibility to issuers allowing issuers to structure their securities offerings in a variety of ways, depending upon their particular needs.

All companies qualify to use Form S-1 regardless of their size, line of business and type of security being registered.

Even after The Jumpstart Our Business Startups Act (“JOBS Act”), Form S-1 is the most commonly used method of raising capital and going public. The form can be used to register shares for seed stockholders or larger accredited investors. Form S-1 provides transparency to investors and is a cost and time-effective solution for companies seeking to raise capital and go public. Read More