Nine Individuals Indicted in Global Resource Energy Inc (GBEN) “Pump and Dump” Scheme

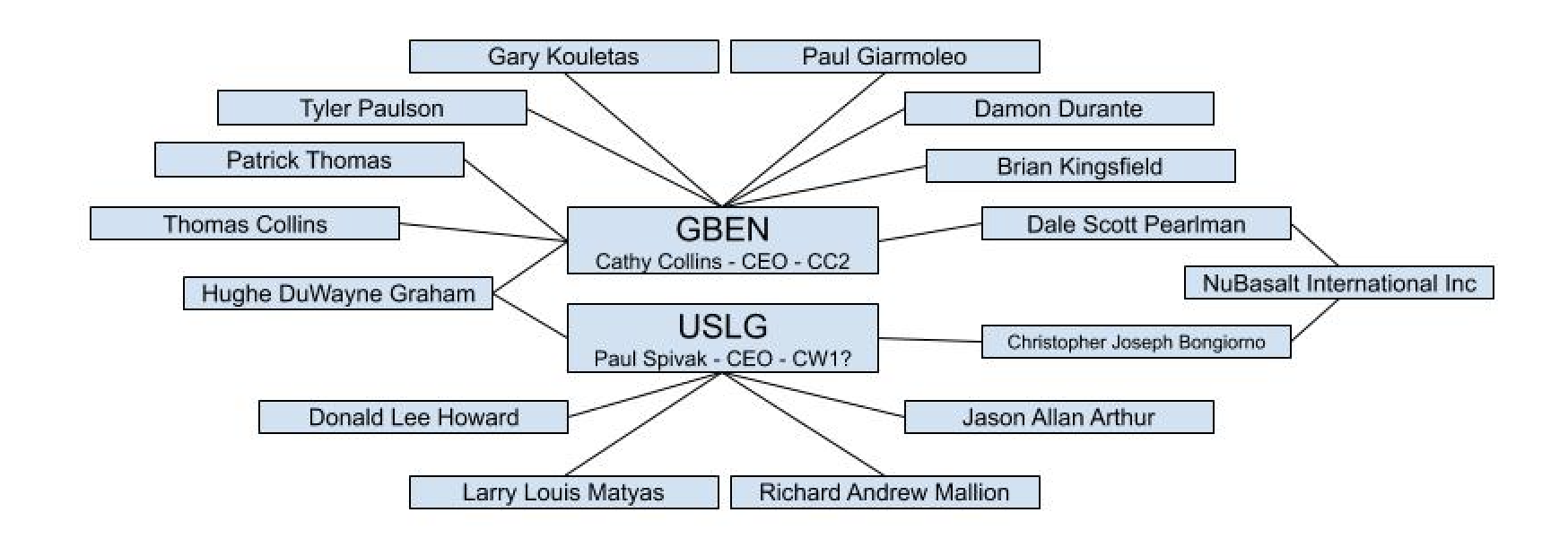

On December 17, 2020, the United States Department of Justice unsealed an Indictment against nine individuals charged in a “pump and dump” stock manipulation scheme involving Global Resource Energy Inc (GBEN) filed in the Northern District of Ohio, Eastern Division.

Charged and arrested in the case were:

-

- Thomas Collins, a relative of the GBEN executive officer, Cathy Collins, described as owning a substantial number of GBEN shares through his family members, co-conspirators, and associates over which he had influence and control.

- Patrick Thomas, a substantial GBEN shareholder and convertible note holder (through View Point Health Investments LLC, Sims Investment Holdings, Gulf Coast M&A Ltd, and Avila P&H LLC).

- Tyler Paulson, a substantial GBEN shareholder and convertible note holder (through Super Boat Marine Inc).

- Hughe Duwayne Graham, an unlicensed stockbroker (through HDG Global Marketing LLC), solicited potential investors using the alias “Michael Strong” to purchase GBEN stock.

- Brian Kingsfield, an unlicensed stockbroker that solicited potential investors to purchase GBEN stock.

- Dale Pearlman, an unlicensed stockbroker that solicited potential investors to purchase GBEN stock.

- Gary Kouletas, an unregistered broker-dealer (through PAG Group LLC) that liquidated shares in GBEN for the benefit of Collins, Thomas, and Paulson, receiving compensation in the form of kickbacks or commissions.

- Paul Giarmoleo, an unregistered broker-dealer that worked with Kouletas at PAG Group LLC and through Private Resources LLC, liquidating shares in GBEN for the benefit of Collins, Thomas, and Paulson, receiving compensation in the form of kickbacks or commissions.

- Damon Durante, a substantial GBEN shareholder through his personal companies (including Verde Asset Management LLC), co-conspirators, and associates over which he had influence and control that received kickbacks and undisclosed commissions for the sale of GBEN stock and paid other unlicensed stockbrokers for soliciting and selling GBEN stock.

Not charged but referenced in the case were:

-

- Co-Conspirator 1: An unnamed registered stockbroker and “market maker” said to have used his position as a market maker to facilitate match trades for the benefit of co-conspirators.

- Co-Conspirator 2: the GBEN CEO, Cathy Collins.

- Cooperating Witness (CW-1): an unnamed stock promoter and CEO of several public companies described as being under federal investigation for securities fraud-related offenses but not yet charged. The FBI relied heavily on information provided by this individual to build their case.

- Undercover Employee (UCE-1): an unnamed employee involved in GBEN that consensually recorded telephone conversations with Thomas and Collins

- 4 nominees, including one that owned Streamworx Consulting LLC, a significant shareholder and convertible note holder in GBEN.

According to the Indictment, from around February 2014 through August 18, 2020, the nine defendants, and others, known and unknown, conspired to defraud investors and potential investors of GBEN by issuing millions of shares to themselves at little to no cost, including using convertible notes issued to themselves and nominees to conceal their ownership, then controlled the price and volume of shares through a pump and dump/stock manipulation scheme involving match trading and “painting the tape” to artificially inflate the price of GBEN, paying kickbacks and undisclosed commissions to unregistered brokers to solicit investors to purchase the GBEN shares from the defendants.

- Kouletas is charged with Conspiracy to Commit Securities Fraud.

- Giarmoleo is charged with Conspiracy to Commit Securities Fraud.

- Kingsfield, Durante, and Pearlman are each charged with Conspiracy to Commit Securities Fraud, one count of Securities Fraud, and one count of Mail Fraud.

- Graham is charged with Conspiracy to Commit Securities Fraud, three counts of Securities Fraud, six counts of Wire Fraud, and three counts of Mail Fraud.

- Thomas is charged with Conspiracy to Commit Securities Fraud, three counts of Securities Fraud, and three counts of wire fraud.

- Collins is charged with Conspiracy to Commit Securities Fraud, six counts of Securities Fraud, nine counts of Wire Fraud, and three counts of Mail Fraud.

- Paulson is charged with Conspiracy to Commit Securities Fraud and 3 counts of Wire Fraud.

According to the Indictment, Paulson’s involvement in the scheme dates back the furthest. He caused several convertible notes to be issued in his name and the name of nominees between February 2014 and June 2015.

In the fall of 2018, Paulson and Thomas began doing several deals together involving existing debt and shares owned by Paulson. That was followed by significant changes in the GBEN management team and business operations and the creation of several new convertible notes.

The scheme to defraud investors began in March of 2019 and continued until August 18, 2020, when the SEC suspended trading in GBEN.

That same day, August 18, 2020, three of the GBEN defendants were arrested – Thomas Collins, Patrick Thomas, and Hughe Duwayne Graham. The Complaint against Graham, filed with a Grand Jury on August 14, 2020, describes Graham’s role in the scheme in much more detail, including how Graham got in touch with the FBI’s unnamed cooperating witness (CW-1) in October of 2019, putting the GBEN scheme on the FBI’s radar and dooming Graham and the others.

The Complaint against Collins and Thomas filed on August 14, 2020, goes into detail about how the FBI’s uncover employee (UCE-1) began consensually recorded phone calls with Collins and Thomas starting in March of 2020, further exposing the scheme.

Between August and December, the FBI built its case against the other 6 defendants, eventually charging and arresting Paulson, Kingsfield, Kouletas, Durante, Giarmoleo, and Pearlman on December 18, 2020, for their roles in the scheme.

The Curious History of SEC Litigation and US Lighting Group Inc (USLG)

One of the GBEN Defendants, Hughe Duwayne Graham, was also recently named in SEC litigation for a separate case. On November 9, 2020, Hughe Duwayne Graham was charged by the SEC, along with Donald Lee Howard and Larry Louis Matyas, for acting as unregistered brokers in the sale of the securities of US Lighting Group, Inc (USLG) between October 2017 and May 2019. According to the SEC Complaint, much like with GBEN where he solicited sales of GBEN stock from victims under an alias, “Michael Strong,” Graham solicited victims to purchase USLG stock under the alias, “John Morgan.”

That was only the latest of a long line of recent SEC cases brought against individuals for selling unregistered stock in US Lighting Group Inc.

The SEC previously filed charges against Richard Andrew Mallion related to US Lighting Group Inc (USLG) on October 10, 2019, in the Southern District of Florida. The SEC charged Mallion with engaging in fraud, acting as an unregistered broker, and participating in an unregistered securities offering in connection with two issuers, Virtual MediClinic USA LLC and The Luxurious Travel Corp./US Lighting Group, Inc. (“LXRT/USLG”). According to the SEC’s complaint, from at least May 2016 until October 2018, Mallion solicited individual investors throughout the United States to invest in securities issued by Virtual MediClinic and LXRT/USLG.

Mallion settled the case on October 14, 2019, accepting a permanent penny stock ban and agreeing to pay $634,510.63, representing profits gained as a result of the conduct alleged in the Complaint, together with prejudgment interest thereon in the amount of $18,605.68 and a civil penalty in the amount of $150,000.00.

Mallion was previously Indicted in 1996 as part of a massive stock manipulation ring during his time as a broker at F.D. Roberts Securities Inc. and previously charged by the SEC in 1991, along with others, for running a boiler room operation selling pink sheet stocks out of an unregistered brokerage firm.

US Lighting Group Inc (USLG) also showed up in SEC litigation on February 28, 2020, when charges were filed against Jason Allan Arthur and Christopher Joseph Bongiorno with engaging in fraud and acting as unregistered brokers in connection with the securities offerings of two issuers, US Lighting Group, Inc. (USLG) and Petroteq Energy, Inc. (PQEFF). According to the SEC’s complaint, filed in the U.S. District Court for the Northern District of Ohio, Arthur and Bongiorno used aliases to convince USLG management that they held the requisite securities licenses to engage in investor solicitations. From September 2015 through November 2018, Arthur and Bongiorno allegedly solicited individual investors throughout the United States to invest in securities issued by USLG and PQEFF. In order to obfuscate their receipt of commissions, Arthur and Bongiorno allegedly submitted misleading invoices to USLG and PQEFF. Arthur and Bongiorno allegedly received commissions of 35% to 50% of investor funds, totaling at least $1,174,057.10 and $2,356,358.91, respectively. That case is still pending.

Christopher Joseph Bongiorno was previously Indicted on October 29, 2014, for Conspiracy to Commit Securities Fraud in connection with soliciting individuals to invest in a company called NuBasalt International Inc together with one of the individuals charged in the GBEN Indictment, Dale Pearlman. According to the Indictment, Pearlman and Bongiorno misappropriated $562,000 for their own personal use. The charges were dismissed against Bongiorno after he accepted a Plea Deal and followed through with all of the terms of his deal.

That makes 3 separate SEC cases brought against a total of 6 different individuals for acting as unregistered brokers selling USLG stock, but to date, no charges have been brought against Paul Spivak who was the US Lighting Group Inc CEO during each of the occurrences.

The Recidivist Securities Violations Involved in the GBEN Case

Dale Pearlman was previously Indicted on June 12, 2014, for Conspiracy to Commit Securities Fraud for his involvement in an investment scheme involving NuBasalt International Inc, a purported basalt fiber company. Instead of using the money raised for the NuBasalt business operations, Pearlman and his co-conspirator, Christopher Joseph Bongiorno, misappropriated $562,000 for their own personal use. Pearlman was sentenced to 3 years of supervised release, but after violating the terms of his supervised release, Pearlman was sentenced to 3 months in prison on June 19, 2018, which he began serving on July 23, 2018. That means he got involved in the GBEN scheme not long after his release.

On November 4, 2019, Pearlman was named in an SEC Complaint along with Richard Eden for engaging in fraud, acting as unregistered brokers, and participating in an unregistered offering in connection with the sale of microcap securities. According to the SEC’s complaints, beginning in at least September 2014, Eden and Pearlman solicited investors to purchase shares of a microcap issuer, Intertech Solutions, Inc. (ITEC). The SEC also charged Christopher Neumann for acting as an unregistered broker in connection with his work with Eden.

According to the SEC Complaint against Pearlman, Pearlman assisted William Scott Marshall (referenced only by his initials W.M.) to sell ITEC stock he secretly controlled, engaging in a matched-trading scheme to manipulate the share price in the process. William Scott Marshall had previously been named in an SEC Complaint for the ITEC share selling scheme along with David Michael Naylor on August 21, 2018.

On November 12, 2019, Pearlman settled the case, agreeing to refrain from future violations and pay $115,000 in disgorgement plus $13,392.99 in prejudgment interest and a $50,000 civil penalty in the ITEC case.

Brian Kingsfield also has a history of securities violations. Kingsfield was Indicted for Conspiracy to Commit Securities Fraud on February 12, 2015. According to the Indictment, Kingsfield was hired by two unnamed individuals with the initials J.P. and W.A. to contact investors to solicit them to invest in three pink sheet companies, Sycamore Ventures Inc (SYVN), Systems America Inc (fka SYAI), and Healthient Inc (SNAX), which now trades as Curative Biosciences Inc (CBDX). The scheme took place from January 2010 to November 2012. Kingsfield accepted a guilty plea in April of 2015, but his sentencing didn’t occur until November of 2017. He was sentenced to 12 months in prison, which he began serving on February 16, 2018.

Global Resources Inc (GBEN) has a long history of pump & dump activity. On August 24, 2020, just days after the SEC suspension, the Alberta Securities Commission (ASC) concluded that enough evidence exists to move their case against the former insiders of both GBEN and BluForest Inc (BLUF), Cem (Jim) Can and Charles Michael Miller to the next phase. According to the 83 page ASC decision, Can and Miller engaged in conduct that perpetrated a fraud on investors between December 2010 and November 2013.

Despite the years of fraud and abuse perpetrated against investors, GBEN was moved from the grey market to the “Expert Market” by the OTC Markets Group on October 1, 2020.

For further information about this securities law blog post, please contact Brenda Hamilton, Securities Attorney at 101 Plaza Real S, Suite 202 N, Boca Raton, Florida, (561) 416-8956, by email at [email protected] or visit www.securitieslawyer101.com. This securities law blog post is provided as a general informational service to clients and friends of Hamilton & Associates Law Group and should not be construed as, and does not constitute legal advice on any specific matter, nor does this message create an attorney-client relationship. Please note that the prior results discussed herein do not guarantee similar outcomes.

Hamilton & Associates | Securities Lawyers

Brenda Hamilton, Securities Attorney

101 Plaza Real South, Suite 202 North

Boca Raton, Florida 33432

Telephone: (561) 416-8956

Facsimile: (561) 416-2855

www.SecuritiesLawyer101.com