Undercover Sting Takes Down Francis Biller, Raymond Dove, and Chester Alvarez in Boiler Room Scheme

On March 15, 2022, the Securities and Exchange Commission (the “SEC”) announced charges against five individuals for allegedly operating a call center in Medellin, Colombia, which used high-pressure sales tactics and made false and misleading statements to retail investors to convince them to buy the stocks of small companies trading in the U.S. markets.

According to the SEC’s complaint, filed on March 14, 2022, from at least January 2016 to at least July 2018 (the “Relevant Period”), U.S. citizen Chester Alvarez, Canadian citizens Francis Biller, Raymond Dove, and Troy Gran-Brooks, and Dutch citizen Justin Plaizier (the “Defendants”) operated call centers (also known as “boiler rooms”), set up as phony investment management firms, with fake names, websites, and phone numbers.

Defendant Francis Biller had previously pled guilty to four counts of theft and fraud in British Columbia in 2005 in connection with an investment fraud run through Eron Mortgage Corporation. In 1999, Eron Mortgage and its key executives perpetrated one of the biggest swindles in Canadian history. The British Columbia Securities Commission estimated that 3,200 investors, most of them from B.C., lost C$ 170 million. Biller was sentenced to three years in prison and was permanently banned by the Ontario Securities Commission (OSC).

The SEC’s complaint alleges that Defendants were hired by groups of people who controlled the stock of the issuers whose stock they were touting. These groups of people (called “control groups”) owned a significant percentage of the issuers’ free trading stock, oftentimes as much as 100% of the float.

During the Relevant Period, Defendants’ boiler room promoted the stock of at least 18 issuers, in coordination with control groups who were dumping their shares of those issuers. The demand created by Defendants’ misleading promotions enabled control groups to sell millions of shares of stock, which generated over $58 million in trading proceeds for the control groups. The stock of many of these issuers was thinly traded in the market when it was not being touted in one of the Defendants’ promotional campaigns, so investors who purchased these shares at Defendants’ urging often had difficulty finding buyers when trying to sell their shares once Defendants’ promotions were over.

To promote these issuers’ shares, Defendants pretended to be affiliated with various non-existent financial advisory firms, making up legitimate-sounding names for these phony financial advisory firms and creating legitimate-looking websites for them. When making telephone calls, Defendants routinely used spoofed phone numbers to show area codes that made it appear as if they were calling from the United States rather than Colombia. When calling and emailing unsuspecting investors, Defendants also used false names, made false or misleading statements about the prospects of the companies whose stock they were touting, and failed to disclose that they were acting in coordination with control groups that were dumping their securities into the market.

According to the SEC, in the spring of 2018, Biller and Dove were looking for a new source of clients who had stock that could be promoted by their boiler room. Dove had previously partnered with an individual (referred to as “Person A”) in a number of other pump and dump deals. In the spring of 2018, Person A introduced the Defendants to an individual (“Person B”) who purported to be looking for a boiler room to promote several issuers’ stocks. Unbeknownst to Person A and the Defendants, Person B was working in an undercover capacity with law enforcement officials and recorded his communications with Person A and the Defendants.

During conversations between the Defendants and Person A and Person B, the Defendants made the following statements:

- Over the last two years, we’ve probably done 15 deals, and not a single one lasted for more than two months;

- The smallest number raised on any of those transactions . . . would have been like 3.5 million;

- The group did upwards of 10 million dollars on a deal in six weeks and generated over $100 million over its history;

- The group charges 65% of all captured sales;

- The promotions work best when the control group controls the entire float;

- The group likes to run two deals at the same time, starting the 2nd one about six to eight weeks after the first so they can solicit the same investors that they talked into buying the 1st deal while the first deal still looks good;

- After the two deals are done, the group covers its tracks by deleting its websites and disconnecting its phones so that disgruntled investors cannot locate them; then they start over with fresh new names, websites, and phone numbers for the next 2 deals;

- The group would lie to potential investors about the stocks they recommended in the past and about it being a legitimate investment firm;

- The lies the group told to potential investors about the stocks being promoted included claims that it would be uplisting to the NASDAQ within 3 months, which would significantly increase the price; and

- The group would lie about their backgrounds, even going as far as to say they wrote popular books and made appearances on CNN.

The defendants also made ommissions about the control groups they worked for, specifically detailing the Oroplata Resources Corp Inc (ORRP), PureSnax International Inc (PSNX), and Garmatex Holdings Ltd (GRMX) deals, all of which involved a control group led by Luis Carrillo.

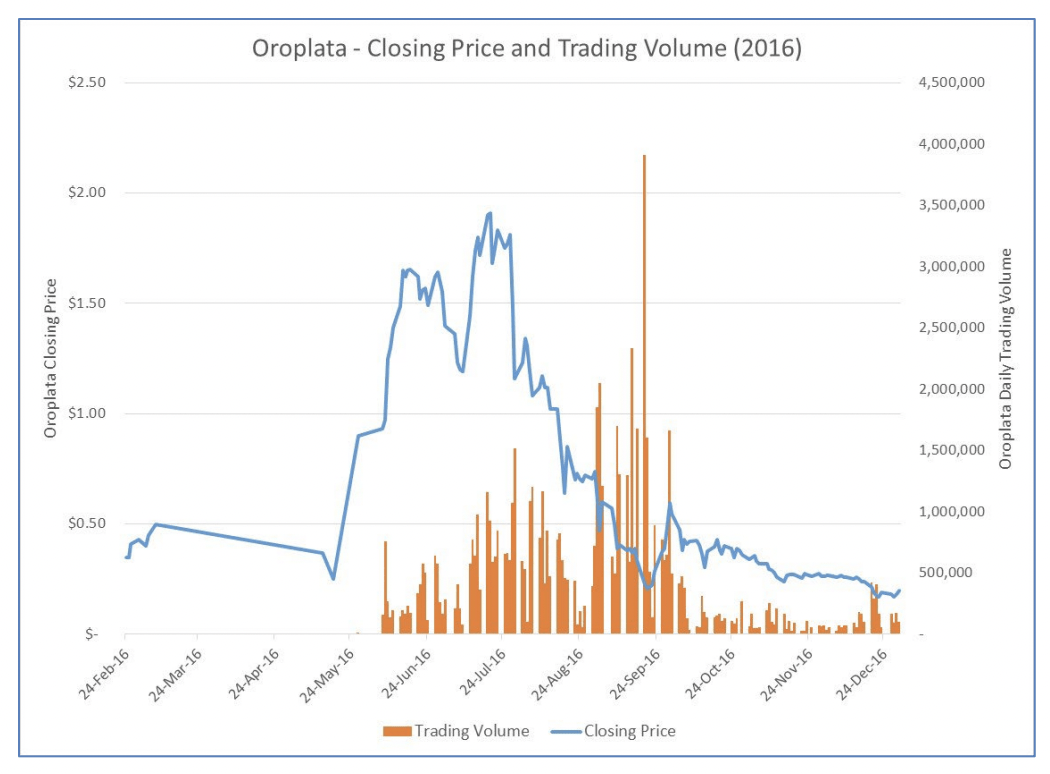

According to the SEC, the Luis Carrillo control group owned 100% of the Oroplata float in 2016, dividing the Oroplata float into at last 7 nominee foreign entities, each of which controlled less than 5% of the O/S to avoid reporting requirements. From on or about June 6, 2016, through at least September 2016, Defendants’ boiler room promoted Oroplata stock. At that time, Defendants were using the names Market Wi$e Report or Winford Report for their phony investor relations firm.

During Defendants’ promotion of Oroplata between June 6 and August 15, 2016, the price of the stock ranged from $0.93 to $1.91. By the end of September 2016, the stock’s price had dropped to $0.545, and the price continued to fall, trading in a range between $0.10 and $0.20 per share into 2017 and eventually dropping below that. Investors who purchased Oroplata on the Defendants’ urging and held their shares lost significant sums of money.

Oroplata now trades as American Battery Technology Company (ABML).

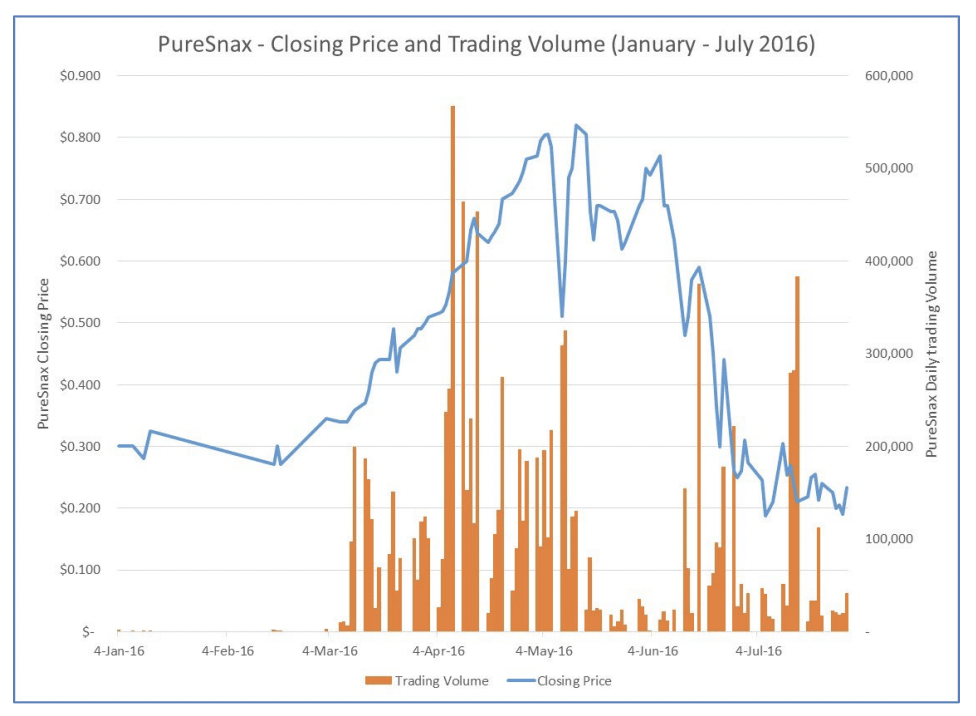

According to the SEC, the Luis Carrillo control group also controlled 100% of the PureSnax float during the stock promotion, dividing the PureSnax stock into blocks of less than 5% of PureSnax’s total number of shares outstanding and transferring the ownership of those blocks of stock to foreign nominee entities, so each nominee owned, on paper, less than 5% of PureSnax’s shares.

From at least mid-March through mid-July 2016, Defendants’ boiler room promoted PureSnax stock. Defendants’ PureSnax promotion overlapped with the time period of their Oroplata promotion, and Defendants used the phony investor relations firm names of Market Wi$e Report or Winford Report to conduct both promotions.

The closing price of PureSnax stock rose from around $0.30 before the promotion to its highest closing price of $.804 and .805 on May 4 and 5, 2016.

During Defendants’ promotion of PureSnax, the price of the stock rose to a high of $0.895 per share. Once the Defendants’ boiler room stopped promoting PureSnax, the stock’s price dropped quickly to below $0.01 per share by September 22, 2016. Many investors who purchased PureSnax on the Defendants’ urging thus lost significant sums of money. PureSnax became iQSTEL Inc (IQST) in 2018.

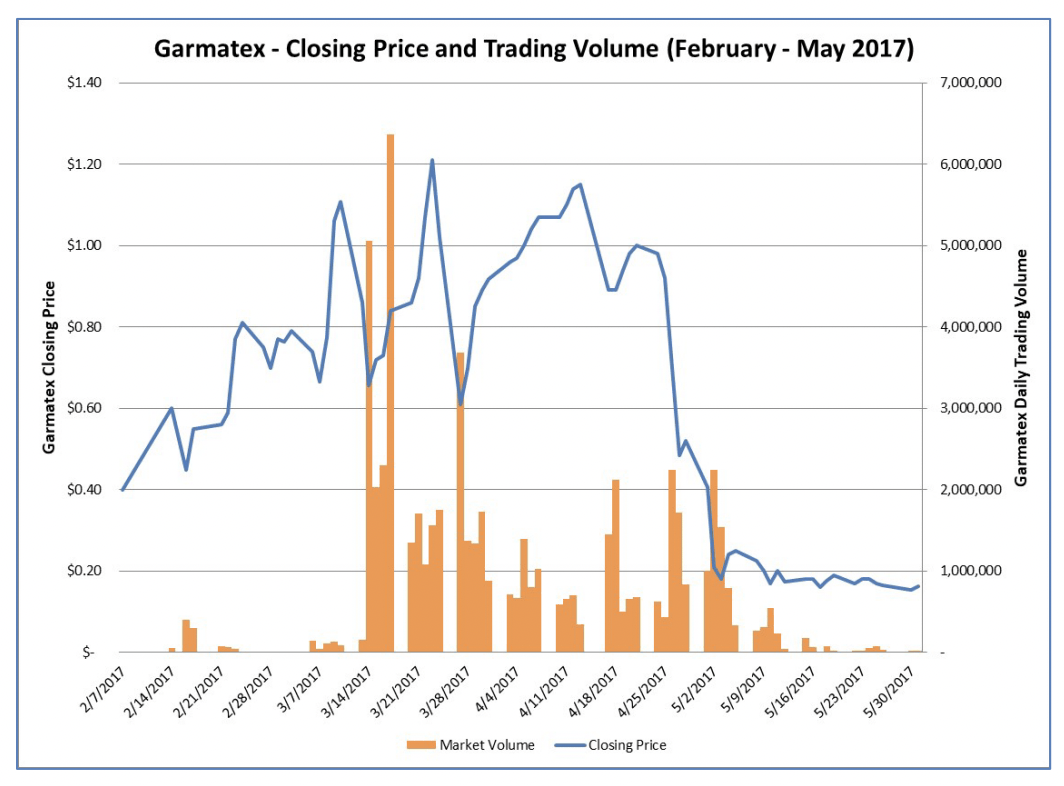

According to the SEC, by March 2017, a control group composed of at least Carrillo controlled nearly 90% of the float of Garmatex had divided their Garmatex shares into blocks of less than 5% of Garmatex’s total number of shares outstanding, and transferred into at least six foreign nominee entities such that each nominee owned, on paper, less than 5% of Garmatex’s shares.

Between March 14, 2017, and May 2, 2017 (the last day that the Garmatex Control Group sold stock), the average volume was over 1.5 million shares per day. The closing price of Garmatex stock rose from $0.40 before the promotion to its highest closing price of $1.21 on March 23, 2017.

Once the Defendants’ boiler room stopped promoting Garmatex, the stock’s price dropped to less than $0.20. Many investors who had purchased Garmatex on the Defendants’ urging thus lost significant sums of money. Collectively, between March 2017 and May 2017, the Luis Carrillo control group sold at least 12.2 million shares of Garmatex stock into the demand created by Defendants’ boiler room, for trading proceeds of over $7,000,000.

Garmatex did a reverse split in February 2018 and became Evolution Blockchain Group Inc (EVBC). The stock was suspended by the SEC on July 10, 2018.

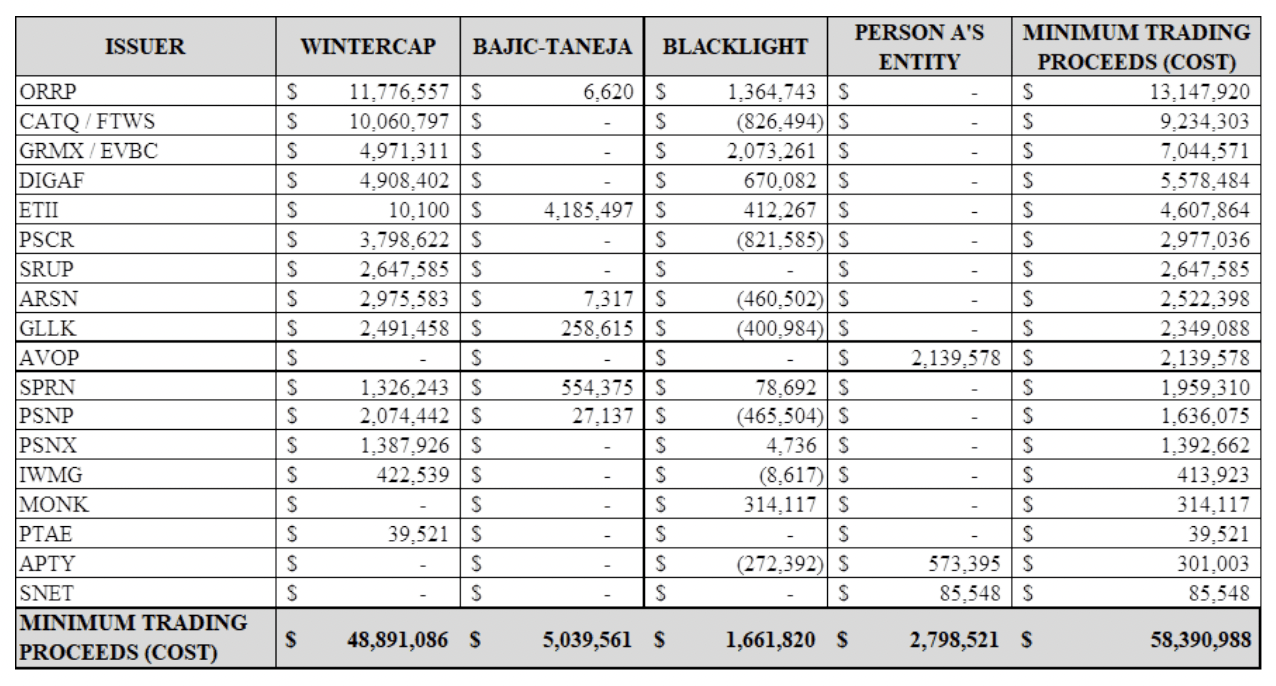

According to the SEC, the control groups sold their stock through brokerage accounts maintained by at least three fraudulent trading platforms: Wintercap SA (“Wintercap”), Blacklight SA (“Blacklight”) and the Bajic-Taneja Platform (collectively, the “Foreign Platforms”).

The following chart summarizes the stocks that were promoted by the Defendants and the trading proceeds that their control group clients reaped by selling into the demand created by the Defendants’ fraudulent conduct:

Our past research has found that the Luis Carrillo control group also controlled the entire float during promotions done on Cataca Resources Inc (CATQ), Flitways Technology Inc (FTWS), Photo Script Pharmaceutical Corp (PSCR), Aureus Inc (ARSN), and Plata Resources, Inc (PTAE), which became Nexus Biopharma Inc (NEXS) (all referenced in the above chart). And it’s possible the Luis Carrillo control group also controlled the float in other stocks mentioned in the above chart.

The GRMX and ARSN promotions were cited in a recent SEC Complaint against Luis Carrillo, Amar Bahadoorsingh, Justin Roger Wall and Jamie Samuel Wilson filed on August 4, 2021.

Wintercap and Blacklight and Bajic-Taneja have been charged in two separate cases for their fraudulent operation of illicit trading platforms for their clients. See SEC v. Knox, No. 18-cv-12058 (D. Mass., filed Oct. 2, 2018) (charging Wintercap, its operator, Roger Knox, and others); SEC v. Bajic, et al., No. 20-cv-0007 (S.D.N.Y., filed Jan. 2, 2020) and SEC v Ciapala et al., No. 20-cv-00008 (S.D.N.Y. filed January 2, 2020) (charging Steve M Bajic, Rajesh Taneja, Kenneth Ciapala, Anthony Killarney, Blacklight, a network of foreign companies (the Bajic-Taneja platform), including Norfolk Heights Ltd., Fountain Drive Ltd., Island Fortune Global Ltd., Crystalmount Ltd., Wisdom Chain Ltd., SSID Ltd., Sure Mighty Ltd., and Tamarind Investments Inc, and a number of associates).

Knox was criminally charged on September 17, 2018, and arrested on October 3, 2018.

Ciapala was criminally charged along with Ulrik Debo on December 5, 2019 (read more here).

All the above-mentioned individuals and entities tie us to Frederick L Sharp, the alleged mastermind that arranged for his clients to deposit stock in Silverton/WinterCap (Roger Knox) and Blacklight SA (Kenneth Ciapala) to obfuscate the control persons’ association with their public company stock. Sharp was charged by the SEC on August 5, 2021, along with 8 other individuals. In parallel proceedings, on August 4, 2021, the US Attorney for the District of Massachusetts charged Sharp, Courtney Kelln, Mike Veldhuis, and Luis Carrillo for conspiracy to commit securities fraud and securities fraud. Read the FBI Affidavit in support for Sharp et al. here.

Person A, who the SEC discloses was part of a control group involved in promotions done on AV1 Group Inc (AVOP), which now trades as Omid Holdings Inc (OMID), APT Systems Inc (APTY), and SourcingLink.net Inc (SNET), which now trades as Oncology Pharma Inc (ONPH), was later charged by the SEC and by the U.S. Attorney’s Office for the Eastern District of New York for his participation in various securities fraud schemes. Our research suggests that Person A may be Michael J Black. AVOP was one of several entities also promoted by another boiler room run by Ubong Uboh and Tyler Crockett, both charged by the SEC on April 20, 2021. According to that SEC complaint, Michael J Black controlled the entire float of AVOP during the promotion. OTC filings disclosure that Black was also a shareholder in APTY. Black was charged by the SEC along with Garrett M O’Rouke on July 17, 2019. Black and O’Roule were also named in a criminal complaint by the US Attorney’s Office for the Eastern District of New York on July 18, 2019.

The SEC’s complaint, filed in the U.S. District Court for the Eastern District of New York, charges Alvarez, Biller, Dove, Gran-Brooks and Plaizier with violations of antifraud provisions of the securities laws and charges Alvarez with violating market manipulation provisions of the securities laws. It also seeks injunctive relief, disgorgement plus prejudgment interest, civil penalties, and a prohibition on participating in any offerings of penny stocks by all defendants.

For further information about this securities law blog post, please contact Brenda Hamilton, Securities Attorney at 200 E. Palmetto Park Rd, Suite 103, Boca Raton, Florida, (561) 416-8956, by email [email protected] or visit www.securitieslawyer101.com. This securities law blog post is provided as a general informational service to clients and friends of Hamilton & Associates Law Group and should not be construed as and does not constitute legal advice on any specific matter, nor does this message create an attorney-client relationship. Please note that the prior results discussed herein do not guarantee similar outcomes.

Hamilton & Associates | Securities Lawyers

Brenda Hamilton, Securities Attorney

200 E. Palmetto Park, Suite 103

Boca Raton, Florida 33432

Telephone 561-416-8956

www.securitieslawyer101.com